Education

Law and Order (Jersey) Amendment Order 2025

Made 29 May 2025

Coming into

force 5 June 2025

Part 1

Education (Jersey) Law 1999

amended

1 Education (Jersey) Law 1999 amended

This Part amends the Education (Jersey) Law 1999.

2 Schedule 2 (courses of

higher education) amended

(1) For

Schedule 2, paragraph 1 there is substituted –

(a) a

course providing education at a level higher than the level of –

(i) the

advanced level for the General Certificate of Education; or

(ii) a

qualification equivalent to the advanced level for the General Certificate of

Education;

(b) a

course for the further training of teachers or youth and community workers.

(2) For

Schedule 2, paragraphs 2 and 3 there is substituted –

Part 2

Education (Grants and Allowances) (Jersey) Order 2018

amended

3 Education (Grants and Allowances) (Jersey)

Order 2018 amended

This Part amends the Education (Grants and

Allowances) (Jersey) Order 2018.

4 Article 1

(interpretation) amended

(1) In

Article 1, after the definition “academic year” there is inserted –

(2) In

Article 1, for the definition “higher education” there is

substituted –

“higher

education” –

(a) means

a course described in Schedule 2 to the Law; but

(b) does

not include a course at postgraduate level unless provided for by Article 9

(professional examinations);

(3) In

Article 1, in the definition “level”, for “qualifications framework for

England, Wales and Northern Ireland on a web-site maintained by the United

Kingdom government” there is substituted “Regulated

Qualifications Framework for England, Wales and Northern Ireland or an

equivalent framework published by the government of any other country or

territory”.

(4) In

Article 1, after the definition “main

residence” there is inserted –

(5) In

Article 1, in the definition “relevant income”, for “Articles 4, 5,

6, 6A or 12A” there is substituted “Articles 4, 5, 6, 6A, 12A or the

Schedule”.

5 Article 3A (meaning of “income“)

amended

(1) In

Article 3A(1)(c), for “any of the following Laws” there is substituted “either

of the following Laws”.

(2) Article 3A(1)(c)(i)

and (iv) are deleted.

6 Article 6 (meaning of

relevant income of independent student) amended

For

Article 6(2) there is substituted –

(a) married

or in a civil partnership; or

(b) living

in a marriage-like relationship or in a civil partnership-like relationship.

(3) The

whole or any part of the income of a student or of their spouse, civil partner

or partner may be disregarded if the student’s family circumstances mean that

it would be unfair to the student not to do so.

7 Article 8 (eligibility

for higher education grant) amended

After Article 8(2)

there is inserted –

(a) in

the opinion of the Minister, the educational provision is of a suitable

standard; and

(b) the

qualification is awarded by an institution regulated by the appropriate body

designated for that purpose by the government in the country

or territory in which the institution is established.

(a) consider

the outcome of an assessment or rating applied to the institution by the

appropriate body designated for that purpose by the government in the country

or territory in which the institution is established;

(b) if

a course is not delivered in the British Islands, require the student to

provide evidence of the regulated status or qualification level of the course

in order for the student to be considered for a grant.

8 Article 9 (professional

examinations) amended

For Article 9(2)

there is substituted –

9 Article 11 (distance

learning) amended

(1) Before

Article 11(1) there is inserted –

(2) In

Article 11(1), for “Article 17” there is substituted “the Schedule”.

(3) In

Article 11(3), for “a student is not required to” there is substituted “an institution does not require a student to”.

10 Article 13CB (student

detained in prison not entitled to maintenance grant) inserted

After Article 13CA

there is inserted –

13CB Student detained in prison not entitled to maintenance grant

(1) A

student who is detained in prison is not entitled to a maintenance grant during

their detention.

(2) In

this Article, “prison” has the meaning given in Article 1(1)

(interpretation) of the Prison

(Jersey) Law 1957.

11 Article 17 (distance

learning course grant) deleted

Article 17 is deleted.

12 Article 20 (reduction of

grant in respect of 4-year courses) amended

Article 20(2)(b) is

deleted.

13 Article 29 (withdrawal of

grant or allowance in cases of failure etc.) amended

For the text of Article 29

there is substituted –

(1) If

a grant has been awarded or an allowance has been paid to a student in respect

of a course or module, that grant or allowance is withdrawn or stopped if –

(a) the student abandons the

course;

(b) the student fails all or

part of the course; or

(c) the institution providing

the course refuses to allow the student to complete it.

(2) A

grant or allowance withdrawn or stopped under paragraph (1) is repayable

under the terms of the undertaking given under Article 31.

(3) But

if a grant or allowance is withdrawn or stopped under paragraph (1)(a),

the portion of the grant or allowance relating to a course, or part of a

course, that the student has successfully completed is not repayable.

(4) A

student is considered to have successfully completed a course or part of a

course only if they can provide evidence of completion in the form of an

academic transcript or equivalent issued by the institution providing the

course.

14 Schedule (distance

learning) inserted

After Article 37

there is inserted –

Schedule

(Article 11)

Distance learning courses

1 Scope of Schedule

This Schedule applies if –

(a) a student is undertaking

a distance learning course; and

(b) an application for a

grant for that course is made, in respect of the student, for an academic year beginning

on or after 1 September 2025.

2 Interpretation of

Schedule

(a) enables

a student to accumulate credits;

(b) facilitates

the transfer of a student’s credits within and between higher education

providers; and

(c) is

specified in the Higher Education Credit Framework for England or an equivalent

framework published by the government of any other country or territory;

“student’s category” means the category assigned to a student

according to the student’s description in the following table –

|

|

|

|

Dependent student undertaking a distance

learning course

|

D

|

|

Independent student undertaking a

distance learning course

|

E

|

3 Meaning of relevant income

of dependent student

(1) This

paragraph applies if –

(2) The

relevant income in respect of a dependent student for an academic year is the

gross income of the student’s parents for the calendar year preceding the

calendar year in which the student’s first module of the academic year commences.

(3) If

a parent dies during an academic year, the amount of their income that has been

applied for the purposes of calculating the dependent student’s relevant income

for the academic year is reduced by a portion equivalent to the unexpired

portion of that academic year.

(4) If,

as the result of an event beyond the control of the parents, the parents’

income for the calendar year in which the student’s first module of the

academic year commences is likely to be 80% or less of their income for the

preceding calendar year, the relevant income of the student may be determined

by reference to the parents’ gross income for the calendar year in which the module

commences.

(5) The

income of a parent is disregarded if –

(a) the parent dies before

the student’s first module of the academic year commences;

(b) the parent cannot be

found, or it is not reasonably practicable to contact the parent; or

(c) the student is the

subject of an order committing the student to the care of the Minister for

Children and Families made under the Children (Jersey)

Law 2002 or was the subject of an order before

attaining full age.

(6) The

whole or any part of the income of a parent may be disregarded if the student’s

family circumstances mean that it would be unfair to the student not to do so.

(7) If

paragraph 6 (meaning of relevant income of certain dependent students

living with a single parent) applies, this paragraph has effect with the

modifications specified in paragraph 6(5).

4 Meaning of relevant

income of dependent student living with relevant person

(1) This

paragraph applies in the case of a dependent student who lives in their main

residence in Jersey with a parent and a relevant person, unless paragraph 3(1)(b)

applies.

(2) A

“relevant person” is, for the purposes of Article 51(e)(iii) of the Law

(grants and loans), a person who –

(a) is not a parent of the

dependent student;

(b) is married to, or is in a

marriage-like relationship with that student’s parent or has formed a civil

partnership, or is in a civil partnership-like relationship with that student’s

parent; and

(c) is living with a parent

of that student.

(3) The

relevant income in respect of a dependent student for an academic year is the

sum of the gross income of the student’s parent and the gross income of the

relevant person for the calendar year preceding the calendar year in which the student’s

first module of the academic year commences.

(4) For

the purposes of determining a relevant person’s income, any amount payable by

the relevant person (whether under an order of a court or any other agreement)

for the maintenance of a person dependent on the relevant person is deducted.

(5) In

sub-paragraph (4), “a person dependent on the relevant person” does not

include the dependent student to whom this paragraph applies or the parent with

whom the relevant person is living.

(6) If

a relevant person dies during an academic year, the amount of their income that

has been applied for the purposes of calculating the dependent student’s

relevant income for the academic year is reduced by a portion equivalent to the

unexpired portion of that academic year.

(7) The

income of a relevant person is disregarded if –

(a) the relevant person dies

before the student’s first module of the academic year commences; or

(b) the student is the

subject of any order committing the student to the care of the Minister for

Children and Families made under the Children (Jersey)

Law 2002 or was the subject of an order before attaining full age.

5 Meaning of relevant

income of independent student

(1) The

relevant income in respect of an independent student for an academic year is

the sum of –

(i) the student is married, the student’s

spouse’s gross income for the calendar year preceding

the calendar year in which that module starts;

(ii) the student is in a

civil partnership, the student’s civil partner’s gross income for the calendar

year preceding the calendar year in which that module starts; or

(iii) the student is living

with a partner in a marriage-like relationship or a civil partnership-like

relationship, the student’s partner’s gross income for the calendar year preceding

the calendar year in which that module starts.

(a) married

or in a civil partnership; or

(b) living

in a marriage-like relationship or in a civil partnership-like relationship.

6 Meaning of relevant

income of certain dependent students living with a single parent

(1) This

paragraph applies if –

(a) a dependent student lives

with a single parent;

(b) an application for a

grant for a distance learning course is made, in respect of the student, for an

academic year beginning on or after 1 September 2025 (the “grant

application year”);

(c) the student was eligible

for consideration for, and had applied for, a grant in respect of that course

(whether or not the grant was awarded) –

(i) in the 2021 academic year; and

(ii) in each other academic

year beginning on or after 1 September 2022 but preceding the grant application

year; and

(d) none of the circumstances

mentioned in Article 29(1)(a) to (c) have arisen in relation to the

student and the course.

(2) For

the purposes of sub-paragraph (1)(a) a student lives with a single parent

if –

(a) the student

lives in their main residence in Jersey with 1 parent (the “single parent”);

and

(b) no other parent or

relevant person also lives in that main residence.

(3) Two

different distance learning courses in higher education that would together

lead to a single qualification are to be treated, for the purposes of sub-paragraph (1),

as if they were the same course.

(4) If

this paragraph applies, the relevant income in respect of the dependent student

for the grant application year is the single parent’s gross income for the

calendar year preceding the calendar year in which the grant application year

begins.

(5) Paragraph 3

has effect in relation to the dependent student with the following

modifications –

(a) Paragraph 3(2) is

disregarded (and sub-paragraph (4) of this paragraph applies instead);

(b) Paragraphs 3(3) to

(6) have effect as if each reference (however expressed) to a parent, or the

parents, of the dependent student were a reference to the single parent.

(6) In

this Article, “2021 academic year” means the academic year beginning on 1 September

2021.

7 Eligibility for

distance learning course grant

(1) A

student is eligible for consideration for a grant in respect of a distance

learning course or module only if –

(a) the course or module

forms part of a degree programme or enables the student to continue to a degree

programme at another institution by way of credit accumulation and transfer;

(b) the institution providing

the qualification is regulated by the appropriate body in the British Islands;

and

(c) in the opinion of the

Minister, the educational provision is of a suitable standard.

(2) When

determining whether a module, course or degree programme meets the eligibility

criteria for student to be considered for a grant, the Minister may do any of

the following –

(a) require a student to

provide evidence that the module, course or degree programme meets the

standards of credit accumulation and transfer, in order for the student to be

considered for a grant;

(b) consider guidance from a

government-designated regulatory or standards-setting body in the British

Islands;

(c) consider the outcome of

an assessment or rating applied to the institution by the appropriate body

designated for that purpose in the British Islands.

8 Distance learning

course tuition fees grant

(1) For

the 2025 academic year, and subsequent academic years, the amount of tuition

fees grant that may be awarded to a student undertaking a full-time distance

learning course is the lower of –

(a) the amount that may be

awarded to a student in accordance with their relevant income; and

(b) the actual tuition fee

applicable to the course for that academic year.

(2) The

amount of tuition fees grant that may be awarded to a student undertaking a

full-time distance learning course, in accordance with their relevant income, (their

“full-time tuition fees grant entitlement”) is as follows –

|

|

|

|

Less than 115,720

|

9,535

|

|

115,720 or more but less than

126,240

|

8,583

|

|

126,240 or more but less than

136,760

|

7,629

|

|

136,760 or more but less than

147,280

|

6,676

|

|

147,280 or more but less than

157,800

|

5,722

|

|

157,800 or more but less than

168,320

|

4,768

|

|

168,320 or more but less than

178,840

|

3,815

|

|

178,840 or more but less than

189,360

|

2,861

|

|

189,360 or more but less than

199,880

|

1,907

|

|

199,880 or more but less than

210,400

|

954

|

|

210,400 or more

|

0

|

(3) For

the 2025 academic year, and subsequent academic years, the amount of tuition

fees grant that may be awarded to a student undertaking a part-time distance

learning course (“part-time tuition fees grant”) is determined according to the

intensity of the course, based on the number of credits awarded for the course

in that academic year, by calculating the following in order –

(a) the full-time equivalent

number of credits for each academic year of a course (“credits per academic

year”) is determined as follows –

|

Credits per

academic year =

|

total

number of credits awarded to the full degree qualification

|

|

|

full-time

duration of full degree qualification (years)

|

(b) the intensity of the

course for the particular student (“course intensity”) is determined as follows –

|

Course

intensity =

|

credits

to be earned by the student in academic year

|

|

|

credits

per academic year

|

(c) the part-time tuition

fees grant is determined as follows –

(4) For

example, a student has a relevant income of £95,000 and is undertaking a

part-time distance learning course. The full-time course has a duration of 3

years and awards a total of 360 credits. During the academic year, the student

will study 3 modules that award a total of 60 credits. Their part-time tuition

fees grant would be determined as follows –

(5) The

Minister may determine the intensity of a distance learning course by an

alternative method if a course does not attract credits.

(6) If

the Minister is unable to reasonably determine the intensity of a course, the

Minister may refuse to award a tuition fees grant in respect of that course.

9 Distance learning

course maximum maintenance grant if relevant income is less than £52,600

(1) For

the 2025 academic year and for subsequent academic years, a student who is

undertaking a full-time distance learning course and whose relevant income is

less than £52,600 may be awarded the full-time maximum maintenance grant

specified in the following table –

(2) The

amount of maximum maintenance grant that may be awarded to a student

undertaking a part-time distance learning course (“part-time maximum

maintenance grant”) is determined according to the intensity of the course,

based on the number of credits awarded for the course in that academic year, by

calculating the following in order –

(a) the full-time equivalent

number of credits for each academic year of a course (“credits per academic

year”) is determined as follows –

|

Credits per

academic year =

|

total

number of credits awarded to the full degree qualification

|

|

|

full-time

duration of full degree qualification (years)

|

(b) the intensity of the

course for the particular student (“course intensity”) is determined as follows –

|

Course

intensity =

|

credits

to be earned by the student in academic year

|

|

|

credits

per academic year

|

(3) For

example, a dependent student (category D) has a relevant income of £50,000 and

is undertaking a part-time distance learning course. The full-time course has a

duration of 3 years and awards a total of 360 credits. During the academic

year, the student will study 3 modules that award a total of 60 credits. Their

part-time maximum maintenance grant would be determined as follows –

(4) The

Minister may determine the intensity of a distance learning course by an

alternative method if a course does not attract credits.

(5) If

the Minister is unable to reasonably determine the intensity of a course, the

Minister may refuse to award a maintenance grant in respect of that course.

10 Distance learning

course maintenance grant if relevant income is £52,600 or more, but less than

£94,680

(1) For

the 2025 academic year and for subsequent academic years, a student who is

undertaking a full-time distance learning course and whose relevant income is £94,679.99

may be awarded the full-time minimum maintenance grant specified in the

following table –

(2) For

the 2025 academic year and for subsequent academic years, a student who is

undertaking a full-time distance learning course and whose relevant income is £52,600

or more, but less than £94,679.99, may be awarded a full-time maintenance grant

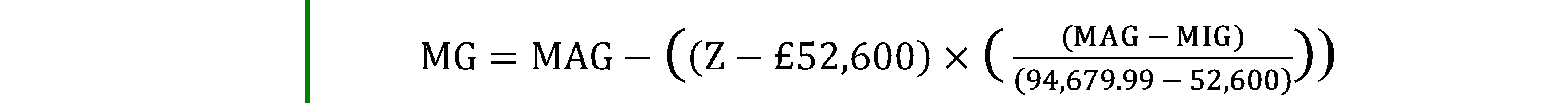

(“MG”) of an amount calculated using the following formula –

“MAG” means the maximum full-time maintenance grant that would be

awardable if paragraph 9 applied to the student instead of sub-paragraph (2);

“MIG” means the minimum full-time maintenance grant that would be

awardable if sub-paragraph (1) applied to the student instead of sub-paragraph (2);

“Z” means the student’s relevant income.

(4) For

example, the full-time maintenance grant (“MG”) awarded to an independent

student (category E) who is undertaking a full-time distance learning course,

and who has a relevant income of £65,000, would be calculated as follows –

(5) For

the 2025 academic year and for subsequent academic years, the amount of maintenance

grant that may be awarded to a student undertaking a part-time distance

learning course (“part-time maintenance grant”) is determined according to the

intensity of the course, based on the number of credits awarded for the course

in that academic year, by calculating the following in order –

(a) the full-time equivalent

number of credits for each academic year of a course (“credits per academic

year”) is determined as follows –

|

Credits per

academic year =

|

total

number of credits awarded to the full degree qualification

|

|

|

full-time

duration of full degree qualification (years)

|

(b) the intensity of the course

for the particular student (“course intensity”) is determined as follows –

|

Course

intensity =

|

credits

to be earned by the student in academic year

|

|

|

credits

per academic year

|

(c) the part-time maintenance

grant is determined as follows –

(6) For

example, an independent student (category E) has a relevant income of £65,000

and is undertaking a part-time distance learning course. The full-time course

has a duration of 3 years and awards a total of 360 credits. During the

academic year, the student will study 3 modules that award a total of 60

credits. Their part-time maximum maintenance grant would be determined as

follows –

(7) The

Minister may determine the intensity of a distance learning course by an

alternative method if a course does not attract credits.

(8) If

the Minister is unable to reasonably determine the intensity of a course, the

Minister may refuse to award a maintenance grant in respect of that course.

Part 3

Final provision

15 Citation and commencement

This Order may be cited as the Education Law and Order (Jersey)

Amendment Order 2025 and comes into force 7 days after it is made.

Deputy R.J. Ward of St. Helier Central

Minister for Education and Lifelong Learning