Social

Security (Jersey) Law 1974[1]

A LAW to establish a scheme of social

security and for connected purposes

Commencement

[see endnotes]

PART 1

INTRODUCTORY

1 Interpretation

(1) In

this Law, unless the context otherwise requires –

“1961 Law” means the Income Tax (Jersey)

Law 1961;

“appointed day” has the

meaning assigned thereto by Article 54;

“benefit” means benefit

under this Law;

“claimant”, in Articles 34A,

34B and 34D –

(a) means a person claiming

long term incapacity allowance; and

(b) also means, in relation

to the review of a decision, any beneficiary affected by the decision;

“contract of service”

means any contract of service or apprenticeship, whether written or oral, and

whether expressed or implied;

“earnings” –

(a) in

relation to a Class 1 insured person, has the meaning given in Schedule 1A;

(b) in

relation to a Class 2 insured person, has the meaning given in Schedule 1B;

“employed person” and “employed

person’s employment” have the meanings assigned thereto by Article 3;

“Health Insurance Fund”

means the Fund established and so called by virtue of Article 21 of the Health Insurance

(Jersey) Law 1967;

“Health Insurance Fund

allocation” has the meaning assigned thereto by Article 30;

“incapable of work” means

incapable of work by reason of some specific disease or bodily or mental

disablement or deemed, in accordance with the provisions of any Order, to be so

incapable;

“insured person” means,

for all the purposes of this Law, a person described in Article 3(1) and

includes, for the purposes only of the liability to pay LTC contributions, a

person described in Article 3(1A);

“Jersey

Index of Earnings” means the Index of Average Earnings produced by Statistics Jersey (within the meaning assigned by Article 2 of

the Statistics and

Census (Jersey) Law 2018);

“Law of 1950” means

the Insular Insurance (Jersey) Law 1950;

“Long-Term Care Fund”

means the Fund established under Article 2 of the Long-Term Care (Jersey)

Law 2012;

“Long-Term Care Fund

allocation” has the meaning given by Article 30;

“LTC contributions” means

long-term care contributions;

“medical board” means a

board appointed under Article 34AA;

“medical examination”

includes bacteriological and radiographical tests and similar investigations,

and references to being medically examined shall be construed accordingly;

“medical practitioner”

means –

(a) a “registered medical

practitioner” as defined in Article 1(1) of the Medical Practitioners

(Registration) (Jersey) Law 1960; or

(b) a “fully registered

person” as defined in section 55 of the Medical Act 1983 of the

United Kingdom;

“Minister” means the Minister for

Social Security;

“Order” means an Order

made by the Minister under this Law;

“pensionable age” shall be

construed in accordance with Article 1A;

“prescribed” means

prescribed by Order;

“relevant contribution

conditions” means, in relation to benefit of any description, the contribution

conditions for benefit of that description as set out in Schedule 2;

“relevant

disease or injury” means, in relation to

long term incapacity allowance, the disease or injury in respect of which that

benefit is claimed or payable;

“relevant loss of faculty”

means the loss of faculty resulting from the relevant disease or injury;

“Social Security Fund” has

the meaning assigned thereto by Article 30;

“Social Security Medical

Appeals Tribunal” means the Tribunal constituted under Article 34;

“Social Security Tribunal”

means the Tribunal constituted by

Order under Article 33A;

“standard

contribution” –

(a) in

relation to a Class 1 insured person, has the meaning given in Schedule 1A;

(b) in

relation to a Class 2 insured person, has the meaning given in Schedule 1B;

“standard rate of

benefit” –

(a) for the purposes of the

old age pension, has the meaning given in Part 1A of Schedule 1;

(b) for the purposes of any

other benefit, has the meaning given in Article 13(2).[2]

(2) For

the purposes of this Law –

(a) “child” means a child

below school leaving age and any other child who is in full-time education;

(b) a person shall be treated

as having a family that includes a child if he or she lives with any child as

part of his or her household;

(c) “school leaving age”

means the upper limit of compulsory school age by virtue of Article 2 of

the Education

(Jersey) Law 1999. [3]

(3) For

the purposes of this Law –

(a) a person shall be deemed

to be over or under any age therein mentioned if the person has or has not

attained that age;

(b) a person shall be deemed

to be between 2 ages therein mentioned if the person has attained the

first-mentioned age but has not attained the second-mentioned age.

(4) For

the purposes of this Law, 2 persons shall not be deemed to have ceased to

reside together by reason of any temporary absence of either or both of them,

and in particular by reason of any such absence at school or while receiving

medical treatment as an in-patient in a hospital or similar institution or by

reason of any absence of either or both of them in such circumstances as may be

prescribed.

(5) The

Minister may by Order prescribe, for any specified purpose or provision of this

Law –

(a) monetary amounts and

benefits of any description (whether or not convertible into money) that are,

or are not, earnings;

(b) without prejudice to the

generality of sub-paragraph (a), descriptions of income that are to be

treated as earnings;

(c) the manner in which the

value attributable to any earnings that are not money is to be determined;

(d) when any earnings are

deemed to be paid;

(e) circumstances in which

notional earnings are to be attributed to a person;

(f) the manner in which a

person’s earnings are to be calculated or estimated;

(g) the manner in which the

amount of a person’s earnings to be treated as comprised in any payment made to

or in respect of the person is to be calculated or estimated; and

(h) earnings of a specified

class or description, made or falling to be made to or by a person, that are to

be disregarded, wholly or in part, in calculating a person’s earnings, or

deducted from such earnings.[4]

(6) [5]

(7) [6]

(8) For

the purposes of this Law, a police officer in the States of Jersey Police Force

is to be taken to be an employee of the Chief Officer of that Force under a

contract of service.[7]

1A Pensionable age[8]

Schedule 1AA has

effect to specify what, in any person’s case, is the person’s pensionable age.

2 General administration[9]

PART 2

INSURED PERSONS AND CONTRIBUTIONS

3 Description and

classification of insured persons

(1) Subject

to the provisions of this Law, every person who immediately before the

appointed day was an insured person under the Law of 1950, and every person

who has attained school leaving age on, or who attains school leaving age

after, the appointed day and who fulfils such conditions as to residence in

Jersey as may be prescribed, shall become insured under this Law and thereafter

continue throughout his or her life to be so insured.

(1A) Subject

to the provisions of this Law, a person who attains school leaving age and is

deemed, in prescribed circumstances, to be resident in Jersey, shall be insured

under this Law for the purposes only of the liability to pay LTC contributions.[10]

(2) For

the purposes of this Law, insured persons shall be divided into the following 2

classes –

(a) Class 1, which shall

comprise employed persons, that is to say, persons gainfully occupied in

employment in Jersey under a contract of service; and

(b) Class 2, which shall

comprise persons not in Class 1.

Hereafter in this Law any

employment by virtue whereof an insured person is an employed person is

referred to as an “employed person’s employment”.

(3) Provision

may be made by Order for modifying the said classification in relation to cases

where it appears to the Minister desirable by reason of the nature or

circumstances of a person’s employment or otherwise.

4 Source of funds

(1) For

the purpose of providing the funds required for paying benefit and for making

any other payments which under this Law are to be made out of the Social

Security Fund, and for providing the Health Insurance Fund allocation and the

Long-Term Care allocation each specified in Article 30, contributions

shall be payable by insured persons and employers in accordance with the

provisions of this Law.[11]

(2) Contributions

shall be of the following 3 classes –

(a) Class 1 contributions

payable in respect of Class 1 insured persons being made up of –

(i) employed persons’ primary Class 1

contributions, and

(ii) employers’ secondary

Class 1 contributions;

(b) Class 2 full rate or

reduced rate contributions payable by Class 2 insured persons; and

(c) long-term care contributions

payable by insured persons. [12]

(3) There

shall also be paid into the Social Security Fund, out of monies provided by the

States, such amounts as are determined in accordance with Article 9A, for

the purpose of contributing to the cost of supplementing contributions in

accordance with Article 9.[13]

(4) There is no obligation under paragraph (3)

to pay into the Social Security Fund an amount for the year 2020.[14]

5 Class 1 contributions

(1) [15]

(2) [16]

(3) Subject

to the provisions of this Law, where in any contribution month earnings are

paid to or in respect of an employed person in respect of any one employment of

the person being an employed person’s employment and –

(a) the person is over school

leaving age; and

(b) the person has been employed

for more than a prescribed number of hours in a prescribed period,

there shall be payable

(except as provided by this Law, without regard to any other payment of

earnings to or for the benefit of the employed person in respect of any other

employment) a primary and a secondary Class 1 contribution.

(4) Subject

to the provisions of any Order made under Article 11(d), the amounts of

primary and secondary Class 1 contributions shall be determined in

accordance with Schedule 1A.[17]

6 Persons to be treated as

employers

In relation to persons

who work under the general control or management of a person other than their

immediate employer, and in relation to any other cases for which it appears to

the Minister that special provision is needed, provision may be made by Order

that for the purposes of this Law the prescribed person shall be treated as

their employer.

7 Methods of paying Class

1 contributions

(1) Except

where provision is otherwise made by Order, an employer liable to pay a

secondary Class 1 contribution in respect of a person employed by the employer

shall be liable to pay also that employed person’s primary Class 1 contribution

on behalf of that employed person, and, for the purposes of this Law,

contributions paid by the employer on behalf of an employed person shall be

deemed to be contributions paid by that employed person.

(2) Notwithstanding

any contract to the contrary, an employer shall not be entitled to make, from

earnings paid by the employer, any deduction in respect of the employer’s own

or any other person’s secondary Class 1 contributions, or otherwise to recover

such contributions from any employed person to whom the employer pays earnings;

and an employer who contravenes or attempts to contravene the provisions of

this paragraph shall be liable to a fine not exceeding level 2 on the standard

scale.[18]

(3) An

employer shall be entitled, subject to and in accordance with any Order, to

recover from an employed person the amount of any primary Class 1 contribution

paid or to be paid by the employer on behalf of the employed person; and

notwithstanding anything in any enactment, any Order under this paragraph shall

provide for recovery to be made by deduction from the employed person’s earnings,

and for it not to be made in any other way.

8 Class 2 contributions

(1) Class 2

insured persons, who are not entitled by virtue of paragraph (2), or being

so entitled do not apply, to pay reduced rate Class 2 contributions, shall

be liable to pay full rate Class 2 contributions.[19]

(2) Reduced

rate Class 2 contributions shall be payable monthly or weekly by Class 2

insured persons who apply to do so and who satisfy such conditions as may be

prescribed in relation to income and classification.[20]

(3) Subject to the provisions of any Order made

under Article 11(d), the amounts of full rate Class 2 contributions

and reduced rate Class 2 contributions payable in any month shall be

determined in accordance with Schedule 1B.[21]

8AA LTC contributions[22]

(1) An insured person’s liability to pay LTC

contributions is subject to any Order.

(2) The amount of an insured person’s LTC

contribution shall be determined in accordance with Schedule 1C.

(3) An insured person shall pay LTC

contributions in accordance with Schedule 1D and the 1961 Law as

modified by Article 49B of that Law.

(4) The liability to pay LTC contributions

commences on 1st January 2015.

8AB Method of paying employee’s

LTC contributions[23]

(1) An employer who is liable, under Article 41B

of the 1961 Law, to deduct tax from earnings payable by the employer to an

employee who is an insured person shall also be liable to pay instalments of

the employee’s LTC contribution on behalf of that employee in accordance with

Schedule 1D and the said Article 41B as modified by Article 49B

of that Law.

(2) For the purposes of this Law, contributions

paid by the employer on behalf of an employee under this Article shall be

deemed to be LTC contributions paid by the employee.

(3) An employer shall be entitled, subject to and

in accordance with Schedule 1D, to recover from an employee the amount of

any employee’s LTC contribution paid or to be paid by the employer on behalf of

the employee.

(4) The liability to pay instalments under this

Article commences on 1st January 2015.

(5) In this Article, “employee” and “employer”

have the same meaning as in Article A15 of the 1961 Law.

8AC Method of paying

sub-contractor’s LTC contributions[24]

(1) A building contractor who is liable, under

Article 41E of the 1961 Law, to deduct tax from payments made to a

sub-contractor who is an insured person or to a person nominated by the

sub-contractor for the purpose shall also be liable to pay instalments of the

sub-contractor’s LTC contribution on behalf of the sub-contractor in accordance

with Schedule 1D and Article 41E as modified by Article 49B of

that Law.

(2) For the purposes of this Law, contributions

paid by the building contractor on behalf of a sub-contractor under this

Article shall be deemed to be LTC contributions paid by that sub-contractor.

(3) A building contractor shall be entitled,

subject to and in accordance with Schedule 1D, to recover from a

sub-contractor, or from a person nominated by the sub-contractor to receive

payments for the sub-contractor, the amount of any LTC contribution paid or to

be paid by the building contractor on behalf of the sub-contractor.

(4) The liability to pay instalments under this

Article commences on 1st January 2015.

(5) In this Article, “building contractor” and “sub-contractor”

have the same meaning as in Article A15 of the 1961 Law.

8A Full contribution record

and contribution factors[25]

(1) For the purposes of this Law, a

contribution factor of 1.00 in relation to any period shall indicate a full

contribution record for that period.

(2) For the purposes of this Law, subject to

paragraph (3) and any Order, the monthly contribution factor for a person

is the sum of the contributions paid into, credited to and supplemented from

the Social Security Fund in respect of the person for the month, divided by the

standard contribution for the month that applies in the person’s case.

(3) The monthly contribution factor for a

person shall not exceed 1.00.

(4) For the purposes of this Law, subject to

any Order, the quarterly contribution factor for a person is the sum of the

monthly contribution factors for the person for each month in the quarter,

divided by 3.

(5) For the purposes of this Law, subject to

any Order, the annual contribution factor for a person is the sum of the

quarterly contribution factors for the person for each quarter in the year,

divided by 4.

(6) For the purposes of this Law, subject to

any Order, the life average contribution factor for a person is the sum of the

annual contribution factors for the person for the period described in

paragraph (7), divided by the number of contribution years specified in

the person’s case in Schedule 1AA.[26]

(7) The period referred to in paragraph (6)

is the period or periods in the aggregate, not exceeding the number of

contribution years specified in the person’s case in Schedule 1AA, for

which contributions have been paid into, credited to or supplemented from the

Social Security Fund in respect of the person and which –

(a) begins on or after the

first day of the month in which the person attains the age of 18 years;

and

(b) ends on or before the

last day of the month before the one in which the person attains pensionable

age.[27]

(8) Where contribution factors are calculated

under this Article for the purposes of determining a contribution factor for a

person, the following contributions shall be disregarded –

(a) contributions which are

not paid on their due dates and are not treated in accordance with any Order as

so paid for the purposes of survivor’s benefit, incapacity pension and old age

pension;

(b) contributions credited

only for purposes other than the purposes of survivor’s benefit, incapacity

pension and old age pension; and

(c) any other prescribed

contribution, in the case prescribed.

(9) The product of the calculation specified in

paragraph (2), (4), (5) or (6) shall be rounded up to the third

decimal place.

9 Supplementation of

contributions

(1) Subject

to the provisions of this Law, monthly contributions in respect of an insured

person shall be supplemented out of the Social Security Fund –

(a) in

the case of a Class 1 insured person, in the circumstances and by the

amount provided by paragraph 4 of Schedule 1A; and

(b) in

the case of a Class 2 insured person, in the circumstances and by the

amount provided by paragraph 5 of Schedule 1B.[28]

(2) [29]

(3) [30]

(4) Provision may be made by

Order for disqualifying a person for receiving supplementation of the person’s

contributions in accordance with paragraph (1) where the person has

intentionally arranged his or her affairs so as to entitle himself or herself

to such supplementation.[31]

9A Contributions by States to supplementation[32]

(1) The

amount required by Article 4(3) to be paid into the Social Security Fund must be determined in

accordance with this Article.[33]

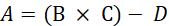

(2) The

amount to be paid for each year shall be the product of the following

formula –

(A – 0.8B) x (1 + C)2

Where –

(a) A

is the total amount required, for the base year, for the purpose of

supplementing contributions in accordance with Article 9, reported in the

accounts prepared in accordance with Article 30(4);

(b) B is the aggregate of the following amounts, as they

are reported in the accounts prepared in accordance with Article 30(4) –

(i) the

Class 1 secondary

contributions paid for the base year in accordance with paragraph 3(2)(c)

of Schedule 1A,

(ii) the

full rate Class 2

contributions paid for the base year in accordance with paragraph 3(c) of

Schedule 1B, and

(iii) the reduced rate Class 2 contributions paid for the base

year in accordance with paragraph 4(c) of Schedule 1B; and

(c) C is

the percentage rise or fall in the Jersey Index of Earnings in the base year.[34]

(3) If 0.8B is equal to or greater than A, no money is

required to be paid for the year.[35]

(4) Despite paragraphs (2) and (3) –

(a) no annual amount is to be

paid for the year 2021; and

(b) the

annual amount to be paid for the year 2022

is £76,140,000.[36]

(4A) [37]

(5) The

amount to be paid under this Article for a year may be paid in a lump sum or in

instalments, and at such time or times, as the Minister determines.

(6) In this Article, “base year” means the year that is 2 years

before the year for which the amount to be paid into the Social Security Fund

is being determined.[38]

10 Exceptions from liability

and crediting of contributions

(1) Provision

may be made by Order for excepting insured persons otherwise liable for

contributions of any class from such liability for such periods and in such

circumstances as may be prescribed.

(2) An

Order made under paragraph (1) shall not except a person from liability to

pay contributions otherwise than on his or her own application, but may provide

for so excepting a person with effect from the day the person’s application is made or a day that is earlier or

later than that day.[39]

(3) Provision

may be made by Order for the crediting of contributions of any class to an

insured person for the purpose of safeguarding future entitlement to benefit

(whether his or her own or another person’s entitlement) but not so as to cause

so much

of his or her contributions as are payable into the Social Security Fund to

exceed the standard contribution.[40]

11 General contribution

provisions

Provision may be made by

Order –

(a) for

treating, for the purpose of any right to benefit, contributions paid after the

due dates as paid on those dates or on such later dates as may be prescribed or

as not having been paid, and for treating, for the purpose aforesaid,

contributions payable by an employer, but not paid, as paid where the failure

to pay is shown not to have been with the consent or connivance of, or

attributable to any negligence on the part of, the relevant employed person,

and in the case of contributions so treated, for treating them also as paid at

a prescribed time or in respect of a prescribed period;

(b) for

treating earnings not paid at normal intervals as paid at such intervals as may

be prescribed;

(c) for

the collection or aggregation of Class 1 contributions or LTC contributions

where a person is employed in more than one employment;

(d) for

calculating or otherwise adjusting the amount of a contribution payable

according to a prescribed scale or figure so as to avoid fractional amounts or

otherwise facilitate computation;

(da) for

calculating or otherwise adjusting any amount determined, in accordance with

this Law, by reference to any index or scale, so as to avoid fractional amounts

or otherwise facilitate computation;

(e) for

securing that liability for the payment of contributions is not avoided or

reduced by means of irregular or unequal payments of earnings or by a person

following, in the payment of earnings, any practice which is abnormal for the

employment in respect of which the earnings are paid;

(f) that,

for the purpose of determining whether a contribution is payable in respect of

any person, that person shall be treated as having attained at the beginning of

a contribution month, or as not having attained until the end of the

contribution month, any age which the person attains during the course of that

month;

(g) for

the return of contributions under this Law paid in error or in such other

circumstances as may be prescribed;

(ga) for

the correction of overpayments or underpayments of contribution made in such

circumstances as may be prescribed;

(h) for

requiring persons to maintain, in such form and manner as may be prescribed,

records –

(i) of the earnings paid by

them to and in respect of employees, and

(ii) of the contributions paid

or payable in respect of earnings so paid,

for the purpose of

enabling the incidence of liability for contributions of any class to be determined,

and to retain the records for so long as may be prescribed;

(ha) for

prescribing circumstances in which the earnings of any employed person may be

treated as being of such an amount, not exceeding any earnings limit specified

in Schedule 1A or 1B, as the Minister considers appropriate;

(hb) for

prescribing circumstances in which the income of any person may be treated as

being of such amount, not exceeding any income limit specified in Schedule 1C,

as the Minister considers appropriate;

(j) for

any other matters incidental to the payment, collection or return of

contributions. [41]

PART 3

BENEFIT

12 Description of benefits[42]

Benefit shall be of the following descriptions –

(a) incapacity benefit, which shall consist of

short term incapacity allowance, long term incapacity allowance and incapacity

pension;

(b) parental benefit, consisting of parental

grant and parental allowance;

(d) survivor’s benefit, which shall consist of

survivor’s allowance and survivor’s pension;

(e) old age pension;

(ea) 2013 old age pension adjustment;

(f) death grant;

(g) insolvency benefit;

(h) home carer’s allowance.

13 Rates and amounts of

benefit

(1) Subject

to the provisions of this Law –

(a) the weekly rates of

benefits and the amounts of any single payment benefits (apart from long term

incapacity allowance and insolvency benefit) are the amounts set out in

Schedule 1;

(b) the weekly rate of long

term incapacity allowance shall be the percentage of the standard rate of

benefit in which the degree of incapacitation, assessed in accordance with the

provisions of Article 16, is expressed; and

(c) the amount of insolvency

benefit shall be calculated in accordance with Articles 26A to 26H.[43]

(2) The

standard rate of benefit for the purposes of this Law (except for the purposes

of the old age pension) shall, on the appointed day, be an amount equal to the

standard weekly rate of parish welfare payable for a single householder on the

appointed day and thereafter shall be increased on the first day of October in

every year by the percentage figure equal to the percentage rise in the Jersey

Index of Earnings during the 12 months commencing July of the preceding

year.[44]

(3) Provision

may be made by Order for –

(a) calculating daily,

monthly and yearly equivalents of the weekly standard rate of benefit;

(b) calculating or otherwise

adjusting the amount of any benefit so as to avoid fractional amounts or

otherwise facilitate computation.

14 Contribution conditions

(1) The

contribution conditions for the several descriptions of benefit (other than

insolvency benefit or the 2013 old age pension adjustment) shall be

as set out in Schedule 2.[45]

(2) Provision

may be made by Order for the entitling to incapacity benefit, home carer’s

allowance, parental allowance, survivor’s benefit and old age pension of

persons who would be so entitled but for the fact that the relevant

contribution conditions set out in paragraphs 1(1)(b), 2(1)(b), 3(1)(b),

3A(1)(b), 4(1)(b) and 6(1)(b) of Schedule 2 are not satisfied.[46]

(3) Any

Order made under paragraph (2) shall provide that benefit payable by

virtue of the Order shall be payable at a rate, or shall be of an amount, less

than that specified in Schedule 1, and the rate or amount prescribed by

the Order may vary with the extent to which contribution conditions are

satisfied.

(4) [47]

15 Short term incapacity

allowance[48]

(1) Subject

to the provisions of this Law, a person who –

(a) is under pensionable age

on any day for which benefit is claimed;

(b) is not entitled to a

reduced old age pension under Article 25(1A); and

(c) satisfies the relevant

contribution conditions,

shall be entitled to short

term incapacity allowance in respect of any day of incapacity for work during a

period of incapacity for work.

(2) Where

in respect of any period of incapacity for work a person has been entitled to

short term incapacity allowance for 364 days (including, in the case of a

woman, any day for which she was entitled to a parental allowance), he or she

shall cease to be entitled to that benefit for any subsequent period of

incapacity for work falling within that period.[49]

(3) A

person shall not be entitled to short term incapacity allowance –

(a) for any period in which

he or she works; or

(b) in respect of any disease

or injury for which he or she is entitled to long term incapacity allowance.[50]

(4) Subject

to the provisions of this Law, where a person who is under pensionable age and

is not entitled to a reduced old age pension under Article 25(1A) ceases

by virtue of paragraph (2) of this Article to be entitled to short term

incapacity allowance –

(a) if he or she satisfies

the requirements of Article 16, he or she shall be entitled to long term

incapacity allowance; or

(b) if he or she satisfies

the requirements of Article 17, he or she shall be entitled to an

incapacity pension.

16 Long term incapacity

allowance[51]

(1) Subject

to the provisions of this Law, a person who –

(a) is under pensionable age;

(b) is not entitled to a

reduced old age pension under Article 25(1A);

(c) as a result of the

relevant disease or injury is suffering from a loss of physical or mental

faculty which is likely to be permanent; and

(d) satisfies the relevant

contribution conditions,

shall be entitled to long

term incapacity allowance.

(2) The

assessment of a claimant’s incapacitation for the purposes of long term

incapacity allowance –

(a) shall be made by a

medical board appointed under Article 34AA, in accordance with –

(i) this Article,

(ii) the provisions of any

Order made under this Article or Article 34AA, and

(iii) Article 34A; and

(b) shall take into account

any period (as to the commencement and duration of which further provision may

be made by Order) during which the claimant has suffered and may be expected to

continue to suffer from loss of faculty resulting in such incapacitation.[52]

(3) If

the claimant is receiving or has received short term incapacity allowance in

respect of the relevant disease or injury, the period to be taken into account

under paragraph (2) shall not begin earlier than the end of the last

period during which he or she received that allowance.

(4) [53]

(5) The

assessment shall specify –

(a) as a percentage, the

degree of incapacitation resulting from the loss of faculty; and

(b) the period taken into

account by the assessment.[54]

(6) In

the assessment of a claimant’s incapacitation –

(a) the percentage and the

period to which paragraph (5) refers shall not be specified more

particularly than is necessary for the purpose of determining the claimant’s

rights in relation to long term incapacity allowance;

(b) if the percentage so

specified is lower than 5%, the claimant shall not be entitled to long term

incapacity allowance in respect of that incapacitation; and

(c) a percentage which is

higher than 5% but is not a multiple of 5 shall be treated as being the next

highest percentage which is a multiple of 5.

(7) Subject

to the other provisions of this Article, provision may be made by Order for the

definition of the principles on which incapacitation is to be assessed.[55]

(8) Any

such Order may in particular prescribe that a specified loss of faculty shall

be treated as resulting in a specified percentage of incapacitation.[56]

17 Incapacity pension[57]

(1) Subject

to the provisions of this Law, a person who –

(a) is under pensionable age;

(b) is not entitled to a

reduced old age pension under Article 25(1A);

(c) as a result of the

relevant disease or injury is likely to be permanently incapable of work; and

(d) satisfies the relevant contribution

conditions,

shall be entitled to an

incapacity pension.

(2) An

incapacity pension shall be payable until the beneficiary becomes entitled to a

reduced old age pension under Article 25(1A) or attains pensionable age,

whichever event occurs first.

(3) The

amount of the incapacity pension to which a beneficiary is entitled shall be

calculated as if, in addition to any other contributions paid by the

beneficiary and on his or her behalf, the contributions which would be payable

by or credited to the beneficiary and on his or her behalf had been paid or

credited from the date from which the beneficiary became entitled to the

incapacity pension until the end of the month before the one in which he or she

would attain pensionable age.

(4) An

incapacity pension shall cease to be payable if the beneficiary works but if

the beneficiary subsequently ceases to work and satisfies the requirements in

paragraph (1) he or she shall again be entitled, from the date on which he

or she so ceases work, to an incapacity pension in accordance with this

Article.

18 General provisions

concerning incapacity benefit[58]

(1) For

the purposes of any provisions of this Law relating to incapacity

benefit –

(a) any 2 days of incapacity

for work (whether consecutive or not) within a period of 7 consecutive days

shall be treated as one period of incapacity for work; and

(b) any 2 such periods which

are not separated by a period of more than 13 weeks shall be treated as one

period of incapacity for work.

(2) Provision

may be made by Order for all or any of the following matters relating to

incapacity benefit –

(a) the defining of days

which are or are not to be treated as days of incapacity for work;

(b) the disqualifying of a

person for the receiving of incapacity benefit, for such period not exceeding

13 weeks as may be determined in such manner as may be prescribed, if –

(i) the relevant disease or injury is

attributable to his or her own wilful act,

(ii) he or she behaves in a

manner calculated to retard his or her recovery;

(iii) he or she fails without

good cause to attend for or to submit himself or herself to such medical or

other examination or treatment as may be required in accordance with the Order,

or to observe any prescribed rules of behaviour; or

(iv) he or she is guilty of

obstruction or misconduct in connection with any relevant medical examination

or treatment;

(c) the requiring of a

claimant for or beneficiary in receipt of incapacity benefit –

(i) to submit from time to time to medical

examination for the purpose of determining the effect of the relevant disease

or injury, or the appropriate treatment for it, and

(ii) to submit from time to

time to appropriate medical treatment for that disease or injury;

(d) the imposing in the case

of any class of persons of additional conditions with respect to the receipt of

incapacity benefit and restrictions on the rate and duration of the benefit if,

having regard to special circumstances, it appears to the Minister necessary to

do so for the purpose of preventing inequalities or injustice to the general

body of insured persons.[59]

(3) Any

Order made under this Article requiring persons to submit to medical

examination or treatment may direct that they are to attend for that purpose at

such times and places as may be required by persons specified in the Order.[60]

(4) Where

it appears to the Minister that a question has arisen whether an assessment of

incapacity benefit ought to be revised, the Minister may direct that payment of

the benefit shall be suspended in whole or in part until that question has been

determined.

(5) Without

prejudice to paragraphs (2) and (4), provision may be made by Order for

all or any of the following matters relating to long term incapacity

allowance –

(a) the period for which, and

grounds on which, any award of long term incapacity allowance may be backdated;

and

(b) the calculation of the

amount of any backdated award such as is mentioned in sub-paragraph (a).[61]

18A Home carer’s allowance[62]

(1) Subject

to the provisions of this Law, a person (the “carer”) shall be entitled to a

home carer’s allowance for any day on which –

(a) he or she is regularly

and substantially engaged in caring for another person (the “cared for person”);

and

(b) the conditions in

paragraphs (2) and (3) are satisfied.

(2) The

carer must –

(a) satisfy such conditions

as to residency and presence in Jersey as may be prescribed;

(b) satisfy the relevant

contribution conditions;

(c) not have earnings, for

any prescribed period, that exceed such amount as may be prescribed; and

(d) not receive earnings for

the provision of such care to the cared for person.

(3) The

cared for person must –

(a) meet the criteria for –

(i) the rate payable in respect of the

personal care element of the impairment component under paragraph 6(3)(c)

of Schedule 1 to the Income Support

(Jersey) Regulations 2007, or

(ii) being assessed as being

in need of long-term care under Article 5(1) of the Long-Term Care (Jersey)

Law 2012; and

(b) satisfy such conditions

as to residency and presence in Jersey as may be prescribed.[63]

(4) A

carer who has attained pensionable age shall not be entitled to a home carer’s

allowance in respect of a cared for person unless the carer –

(a) was entitled to such

allowance in respect of the cared for person (or is treated by Order as having

been so entitled) immediately before attaining that age; and

(b) claimed such allowance

before attaining that age.

(5) A

carer shall not be entitled for the same day to more than one home carer’s

allowance.

(6) Where,

apart from this paragraph, 2 or more carers would be entitled for the same day

to home carer’s allowance in respect of the same cared for person, one of them

only shall be entitled as determined in the prescribed manner.

(7) The

Minister –

(a) shall prescribe, for the

purposes of paragraph (1)(a), the circumstances in which a carer is to be

treated as regularly and substantially engaged in caring for a cared for

person; and

(b) may prescribe earnings

that are to be disregarded for the purposes of paragraph (2)(c) or (d).

21 Entitlement to parental

grant[64]

(1) Subject to the provisions of this Law, a

person to whom paragraph (2) applies is entitled to a parental grant upon

the birth or adoption of a child.

(2) This paragraph applies to a person

who –

(a) is

a parent of the child; and

(b) satisfies

the relevant contribution conditions, and any prescribed requirements.

(3) In respect of any one child –

(a) only

one person may receive payment of the parental grant; but

(b) where

more than one person is entitled to parental grant, the grant must be paid, in

the following order of priority –

(i) to

the person who is nominated by the other persons so entitled, in such manner as

may be prescribed, as the parent to whom the grant is to be paid,

(ii) if

no person is nominated, and except in a case of adoption, to the birth mother,

or

(iii) to

the person whose name appears first on the birth certificate or adoption

certificate.

(4) If all persons entitled to the grant have

died, the parental grant may be paid to such other person as may be prescribed.

(5) No more than one parental grant is to be

paid in respect of any one child, but subject to any provision which may be

made by Order, a person is entitled to a parental grant in respect of each

child –

(a) in

a case of the birth of more than one child as a result of the same pregnancy;

or

(b) in

the case of –

(i) an

adoption, by the placement for adoption of more than one child, or

(ii) an

overseas adoption, by more than one child being adopted,

as part of the same arrangement.

(6) Further provision may be made by Order for

the purpose of giving full effect to this Article, and in particular as

to –

(a) the

application of this Article, with or without modification, in relation to a

person or class of persons, including a person who is entitled to a parental

grant and who requests, in such a manner as may be prescribed, that the

parental grant is to be paid prior to the expected date of birth or placement

for adoption, as the case may be;

(b) the

time and manner of payment of parental grant;

(c) the

determination of any dispute between persons regarding the nomination under

paragraph (3)(b).

22 Entitlement to parental

allowance[65]

(1) Subject to the provisions of this Law, a

person to whom paragraph (2) applies is entitled to parental

allowance –

(a) in

the case of a host mother, in accordance with paragraph (3); and

(b) in

the case of a parent, in accordance with paragraphs (4) to (9).

(2) This paragraph applies to a person

who –

(a) is

a parent, or the host mother, of a child; and

(b) satisfies

the relevant contribution conditions, and any prescribed requirements.

(3) The host mother of a child is entitled to

parental allowance –

(a) irrespective

of any other payment of parental allowance to any other person for any period;

but

(b) for

the post-natal period only, and for no other period.

(4) In respect of any one adoption or birth,

the period for which parental allowance is to be paid must not exceed a total

of 32 weeks, but that total –

(a) is

in addition and without prejudice to any entitlement of a host mother under

paragraph (3), in respect of the post-natal period; and

(b) applies

without regard to the number of children adopted or born, or of persons

entitled to the allowance.

(5) The total number of weeks mentioned in

paragraph (4) must fall within the period –

(a) beginning

no earlier than the date which is 11 weeks prior to the expected adoption

date or date of birth; and

(b) ending –

(i) in

the case of adoption, on the day which is 2 years after the date of

adoption, or

(ii) in

any other case, on the day which is the child’s second birthday.

(6) Where one parent entitled to parental

allowance is the birth mother, payment of parental allowance must be made to

the birth mother for the post-natal period.

(7) Where a person entitled to parental

allowance is also a parent exercising a right to paid parental leave under

Article 55E of the Employment (Jersey) Law 2003, parental allowance must be

paid for each week of paid parental leave taken by that person.

(8) No more than 2 parents are entitled to

receive payment of parental allowance in respect of any one adoption or birth, but

where 2 parents are so entitled, they –

(a) must

nominate, subject to paragraphs (6) and (7) and in such manner as may be

prescribed, the parent to whom a parental allowance is to be paid; and

(b) may

specify, subject to paragraph (9) and in such manner as may be prescribed,

the period of weeks for which the allowance is to be paid to a nominated

parent.

(9) Periods specified under paragraph (8)(b)

need not be continuous, but –

(a) no

more than 3 separate periods may be specified for each nominated parent;

and

(b) each

specified period must be of no less than 2 weeks.

(10) Further provision may be made by Order for

the purpose of giving full effect to this Article, and in particular as

to –

(a) the

determination of any dispute between persons regarding the nomination to be

made under paragraph (8)(a);

(b) determination

of an issue or dispute regarding entitlement to parental allowance, or the

period for which or the parent to whom it is payable;

(c) cases

in which particular contribution conditions may be disapplied;

(d) requirements

which must be satisfied for the purpose of making a valid claim to parental

allowance;

(e) cases

in which persons may be disqualified from receiving parental allowance;

(f) cases

in which the period for which parental allowance is payable may be varied, and

variations of that period;

(g) entitlement

to, and payment of, parental allowance in a case where no nomination is made

under paragraph (8)(a);

(h) entitlement

to, and payment of, parental allowance in a case where a parent is no longer

alive;

(i) the

time and manner of payment of parental allowance.

23 Interpretation of

Articles 21 and 22[66]

(1) In Articles 21, 22 and paragraph (2),

references to adoption, the adoption date, overseas adoption and surrogacy are

to be construed, subject to paragraph (2), in accordance with

Article 55A (interpretation for the purposes of Part 5A) of the Employment (Jersey) Law 2003.

(2) For the purposes of Articles 21 and

22 –

“adoption certificate” means a certified copy, issued under

Article 60(2) of the Marriage and Civil Status (Jersey) Law 2001, of an adoption

registration under that Law;

“birth” includes, except where the context otherwise requires –

(a) the

birth of a living child at the full term of pregnancy, and

(b) the

birth of a child, whether living or stillborn, at any time after 24 weeks

of pregnancy;

“birth certificate” means a short form birth certificate, issued

under Article 60(1) of the Marriage and Civil Status (Jersey) Law 2001, relating to a birth

registration under that Law;

“birth mother” means a woman who gives birth to a child, but does

not include a host mother;

“host mother” means a woman who gives birth to a child, in the case

where the child is or is to be placed with a surrogate parent;

“parent” means a person, other than a host mother, who –

(a) is,

or is to be –

(i) named

on the birth certificate or adoption certificate of a child, or

(ii) a

surrogate parent; and

(b) has,

or expects to have, responsibility for the upbringing of the child or the main

responsibility (apart from any responsibility of the birth mother) for the

upbringing of the child;

“post-natal period” means the continuous period of 6 weeks

beginning with the day on which birth occurs.

(3) For the purposes of paragraph (1), a

person is treated as having responsibility, or the main responsibility, for the

upbringing of a child, if the person would have had such responsibility but for

the fact that the child was stillborn after 24 weeks of pregnancy, or has

died.

24 Survivor’s benefit[67]

(1) Subject

to the provisions of this Law, where a person who dies (the “deceased”) is, at

the time of his or her death, married or a civil partner, the spouse or civil

partner who survives him or her (the “survivor”) shall be entitled to

survivor’s benefit if the deceased satisfied the relevant contribution

conditions, and –

(a) in the case of survivor’s

allowance, at the time of the death of the deceased, either the deceased or the

survivor was not entitled to an old age pension, or was under pensionable age;

or

(b) in the case of survivor’s

pension, at the expiry of 52 weeks following the death of the deceased,

the survivor –

(i) has not, since the death of the deceased,

married or formed a civil partnership,

(ii) is under pensionable

age,

(iii) is not entitled to a

reduced old age pension under Article 25(1A), and

(iv) has a dependent child.

(2) Subject

to paragraphs (4) and (6), survivor’s allowance shall be payable to a

survivor for the 52 weeks following the death of the deceased.

(3) Subject

to paragraphs (4), (5) and (6), survivor’s pension shall be payable to a

survivor from the expiry of 52 weeks following the death of the deceased

until the survivor becomes entitled to a reduced old age pension under Article 25(1A)

or attains pensionable age.

(4) A

survivor shall cease to be entitled to survivor’s benefit if he or she marries

or forms a civil partnership.

(5) A

survivor shall cease to be entitled to survivor’s pension when every child who

was a dependent child at the time described in paragraph (1)(b) has ceased

to be a dependent child.

(6) Survivor’s

benefit shall not be payable to a survivor in respect of any period when the

survivor is in a relationship with another person that is like marriage or

civil partnership.

(7) For

the purposes of this Article, “dependent child” means a child who is –

(a) the natural or adopted

child of the deceased or the survivor;

(b) under the age of 25; and

(c) living with the survivor

as part of his or her household.

25 Old age pensions

(1) Subject

to the provisions of this Law a person shall be entitled to an old age pension

if –

(a) the person is over

pensionable age; and

(b) the person satisfies the

relevant contribution conditions.

(1A) Subject

to the provisions of this Law, a person shall be entitled to a reduced old age

pension if –

(a) the person is over the

reduced pension age specified in the person’s case in Schedule 1AA;

(b) the person satisfies the

relevant contribution conditions; and

(c) the person elects, in the

prescribed manner, to take a reduced old age pension under this paragraph.[68]

(1B) An

election under paragraph (1A) shall be irrevocable, and a person who

becomes entitled to a reduced old age pension under that paragraph shall not be

entitled to any increase in that pension by reason of subsequently attaining

pensionable age.[69]

(2) Subject

to the provisions of this Law, an old age pension (whether or not it is a

reduced pension) shall be payable from the date on which the person becomes

entitled to it, and shall be payable for life.[70]

(3) Subject

to the provisions of this Law, a woman over pensionable age shall be entitled

to an old age pension by virtue of the insurance of her husband, being a husband –

(a) to whom she is married at

the time when she attains that age;

(b) in respect of whose death

she was immediately before attaining that age entitled to survivor’s benefit;

or

(c) whom she has married

after attaining that age,

if the following

conditions are satisfied, that is to say –

(i) either that he is over

pensionable age or that he is dead; and

(ii) that he satisfies the

relevant contribution conditions. [71]

(4) Subject

to the provisions of this Law, an old age pension payable to a woman by virtue

of her husband’s insurance shall commence from the date on which the provisions

of paragraph (3) are satisfied in relation to the pension and shall be

payable for life:

Provided that, if a widow

entitled to an old age pension by virtue of her late husband’s insurance

remarries or enters into civil partnership, the pension shall not be payable

for any subsequent period.[72]

(5) A

woman shall not be entitled for the same period to more than one old age

pension, but if she would be so entitled but for this provision, she may, on

such occasions and in such manner as may be prescribed, choose which she shall

be entitled to.

(6) Where

immediately before attaining pensionable age a woman is a widow not entitled to

survivor’s benefit, she may elect that, in calculating for the purpose of her

right to an old age pension by virtue of her own insurance the life average of her

contribution factors, there shall be treated as paid or credited either –

(a) for each contribution

year falling wholly or partly before her husband’s death; or

(b) for each contribution

year falling wholly or partly during the period of their marriage,

contributions equal to the

life average (ascertained as at the date of his attaining pensionable age or

dying under that age) of his contribution factors instead of the contributions

actually paid or credited to her for that year.[73]

(7) Notwithstanding

the foregoing provisions of this Article, and subject to any prescribed

conditions, provision shall be made by Order for entitling a woman who was an

insured person under the Law of 1950 to an old age pension by virtue of her

own insurance on attaining the age of 60.

25A 2013 old age pension

adjustment[74]

(1) A

person shall be entitled to the 2013 old age pension adjustment

if –

(a) on the prescribed date,

the person is eligible for an old age pension or reduced old age pension; and

(b) in accordance with the

Law and any Order made under it, has applied for and, in the case of a reduced

old age pension, elected to take, such pension.

(2) The

Minister shall by Order prescribe –

(a) a date for the purposes

of paragraph (1)(a); and

(b) an amount for the

purposes of paragraph 3 of Part 2 of Schedule 1.

26 Death grant

(1) Subject

to the provisions of this Law, a death grant shall be payable in respect of the

death of any person (in this Article referred to as the “deceased”) if the

deceased either himself or herself satisfied the relevant contribution

conditions, or was at death the husband, wife, civil partner, widower, widow or

a child of the family, of a person satisfying the said conditions, or a child

who –

(a) had, immediately before

the death of some other person satisfying the said conditions, been a child of

the family of that other person; or

(b) was a posthumous son or

daughter of a man satisfying the said conditions.[75]

(2) Notwithstanding

the provisions of paragraph (1), provision may be made by Order for a

death grant to be payable if the relevant contribution conditions were

satisfied by such other person as may be prescribed.

(3) Except

where provision is otherwise made by Order, a death grant shall not be payable

in respect of a death occurring outside Jersey.

26A Qualifying for insolvency benefit[76]

(1) A

person qualifies under this Article if all of the following conditions are

satisfied –

(a) the person was in

employment as, within the meaning of the Employment (Jersey)

Law 2003, an employee of an employer;

(b) the person was so employed

wholly or mainly in Jersey;

(c) the employer is bankrupt;

(d) that bankruptcy is the

principal reason for the fact that the person is no longer so employed;

(e) the employer was liable

to pay Class 1 contributions, in respect of the employee and the employment,

in any one or more contribution months that fell within the period of 3 months

that ended when the employer became bankrupt;

(f) the employer has not

paid the employee in full the amounts specified in Article 26C as they

relate to that employee and that employment.

(2) In

this Article and Article 26C, “bankruptcy” in relation to an employer

includes any form of insolvency that results in an inability on the part of the

employer to continue trading or to continue performing the employer’s activities,

being insolvency that –

(a) has occurred in Jersey or

elsewhere; and

(b) has resulted in the

employer’s going into administration (however expressed), liquidation (however

expressed) or receivership (however expressed) in Jersey or elsewhere or

entering in Jersey or elsewhere into an arrangement (however expressed) with

the employer’s creditors.

(3) For

the purposes of this Article, it does not matter whether an employer’s trading

or activities took place in Jersey or elsewhere.

26B Insolvency benefit and

deductions[77]

A person who qualifies

under Article 26A shall be entitled to an insolvency benefit calculated by

firstly adding the components referred to in Article 26C, secondly making

the deductions (if any) specified in Articles 26F and 26G and finally

applying the discounts (if any) under Article 26D.

26C Components of insolvency benefit[78]

(1) A

component of the insolvency benefit shall be any unpaid amount of wages (where “wages”

has the same meaning as in the Employment (Jersey)

Law 2003) that relate to the person’s service in employment by the

relevant employer during the 12 months that ended with the cessation of

that service.

(2) The

components of the insolvency benefit shall also include any unpaid amounts that

relate to the person’s employment by the relevant employer and are payable to

the person (or would have been payable to the person except for the fact that

the person was dismissed by virtue of the order of a court, being an order

relating to the bankruptcy or winding up of the employer) as follows –

(a) subject to Article 26E,

an amount in lieu of a period of notice of termination of that employment,

where the amount is in accordance with Part 6 of the Employment (Jersey)

Law 2003;

(b) an amount of redundancy

payment in respect of that employment, where the amount is in accordance with Part 6A

of the Employment

(Jersey) Law 2003;

(c) any amount (being an

amount not already accounted for under paragraph (1)) owing in respect of

a holiday actually taken by the person during the 12 months that ended

with the cessation of the person’s service in that employment;

(d) any amount (being an

amount not already accounted for under paragraph (1) or sub-paragraph (c))

that –

(i) accrued as holiday pay at any time during

the 12 months that ended with the cessation of the person’s service in

that employment, and

(ii) under the person’s

contract of employment –

(A) had in those 12 months

become payable to the person in respect of the period of a holiday, or

(B) would in the ordinary

course have become payable to the person in respect of the period of a holiday

if the person’s service in that employment had continued until the person had

become entitled to a holiday.

(3) In

adding the components relating to a person under this Article, if any one

amount (or part of an amount) relates to more than one component it shall not

be counted more than once towards the sum referred to in Article 26B.

(4) Despite

anything in this Article, a component shall not be counted towards the sum

referred to in Article 26B to the extent (if any) that the Minister may

prescribe by Order.

(5) A

reference in this Article to a holiday includes annual leave and leave (if not

already included in annual leave) in respect of public holidays (including

Christmas) and bank holidays.

(6) For

the purposes of paragraph (2)(a), Part 6 of the Employment (Jersey)

Law 2003 shall be read as if any reference to notice in that Part were

to the notice that would apply under that Part in the absence of any relevant

agreement, as referred to in Article 56(7) of that Law, for a period of

notice longer than those specified in paragraphs (1) and (2) of that

Article.

(7) For

the purposes of paragraph (2)(b), Part 6A of the Employment (Jersey)

Law 2003 shall be read as if Article 60D of that Law had no

effect.

26D Cap on insolvency benefit[79]

(1) An

insolvency benefit payable to a person who qualifies under Article 26A

cannot in aggregate exceed an amount of £10,000 in respect of any one

employment of the person.

(2) If

the insolvency benefit payable to a person would (but for the operation of this

paragraph) in aggregate exceed an amount applying under paragraph (1), the

aggregate shall be discounted so that it equals that amount.

(3) The

discounting shall be applied in the following order –

(a) first to the amount of

the component referred to in Article 26C(2)(a);

(b) then to the amount of the

component referred to in Article 26C(2)(b);

(c) then to the total of the

amounts of the components referred to in Article 26C(2)(c) and (d);

(d) then to the amount of the

component referred to in Article 26C(1),

but only to such of the

components (in that order), and to such extent, as is necessary to bring the

aggregate down to the amount that applies under paragraph (1).[80]

(4) The

Minister may by Order prescribe –

(a) a different amount (or

one or more different amounts in respect of more than one employment) for the

purposes of paragraph (1); or

(b) another order in which

amounts are to be discounted under paragraph (3), or proportions in which

those amounts are to be discounted, or both such an order and such proportions.

(5) Anything

so prescribed shall apply instead of what is specified in paragraph (1) or

(3), as the case requires.

26E Pay in lieu of notice:

requirement to be looking for work[81]

(1) For

an amount referred to in Article 26C(2)(a) in lieu of a period of notice

of termination of a person’s employment to be treated as a component of insolvency

benefit, the person must have been, in that period, available for, and actively

seeking, remunerative work.

(2) In

this Article, except to the extent to which the States by Regulations otherwise

prescribe for the purposes of this Article –

“actively seeking” in

relation to a person and to work means doing all of the following –

(a) taking all reasonable

steps (including any appropriate training or work experience) to obtain

suitable work;

(b) not unreasonably turning

down any offer of suitable work; and

(c) attending every interview

with an officer of the Department of Social Security to which the person has

been invited unless the person has a reasonable excuse for not so attending;

“available for” in

relation to a person and to work has the same meaning as under Article 3

of the Income Support

(Jersey) Law 2007;

“remunerative work” has

the same meaning as under Article 3 of the Income Support (Jersey)

Law 2007.

26F Pay in lieu of notice:

deductions of certain amounts[82]

(1) The

following amounts payable to a person in respect of the whole or any part of any

period of notice to which the person is or has been entitled in respect of the

termination of the person’s employment shall be deducted from the component referred

to in Article 26C(2)(a) that relates to the person –

(a) any wages that the person

earns from employment that the person commences during that period (but not any

wages that the person earns during that period from the continuation of any

employment that –

(i) the person started before the beginning of

that period, and

(ii) is employment that the

person intended to engage in in addition to the employment that was

terminated);

(b) any benefit under this

Law in the form of short-term incapacity allowance, as referred to in Article 15;

(c) any benefit under this

Law in the form of parental allowance, as referred to in Article 22;

(d) such part of any amount

of home carer’s allowance, as referred to in Article 18A, as would not

have been payable but for the termination of the person’s employment;

(e) such part of any amount

of income support under the Income Support (Jersey)

Law 2007 as would not have been payable but for the termination of the

person’s employment;

(f) such other amounts as

the Minister may prescribe by Order.[83]

(2) The

reference in paragraph (1)(a) to wages that the person earns from

employment that the person commences during a period includes –

(a) wages to which the person

is entitled in respect of that employment during the period even if payment (in

part or in whole) of those wages occurs after the end of the period; and

(b) wages to which the person

would have been entitled in respect of that employment during the period but

for the fact that the person agreed to waive his or her entitlement to those

wages or to postpone his or her entitlement to those wages until after the end

of the period.

(3) In

this Article, “wages” has the same meaning as in the Employment (Jersey)

Law 2003.[84]

26G Other deductions[85]

(1) If

primary Class 1 contributions would have been payable in respect of any

component specified in Article 26C if that component had been paid by the

employer, their value shall be deducted from the component.

(2) If

income tax payable under the Income Tax (Jersey)

Law 1961 would have been deductible or payable in respect of any

component specified in Article 26C if that component had been paid by the

employer, its value shall be deducted from the component.

(3) Any

amount owed by the employee to the employer in respect of leave that has been

taken in excess of the employee’s entitlement, in respect of any overpayment of

wages or in respect of any other matter shall be deducted from the sum of the

components under Article 26C.

26H Components cannot be

negative[86]

The value (after any

deductions referred to in Articles 26F and 26G have been made) of a

component referred to in Article 26C, or of the sum of the components referred

to in Article 26C, cannot, for the purposes of any of Articles 26A to

26G, be less than zero.

26I Subrogation[87]

(1) The

Minister shall be entitled to be subrogated to the right of a person to recover

any amount referred to in Article 26C(1) or (2), being so entitled to the

extent to which the amount has counted towards an insolvency benefit paid to

the person.

(1A) In

relation to any insolvency benefit paid to a person, the Minister shall also be

entitled to recover the amount of any deduction of value made under Article 26G(1)

or (2).[88]

(1B) The

Minister may recover that amount from a party from whom the Minister is

entitled, pursuant to the subrogation referred to in paragraph (1), to

recover part or all of the amount of the component from which the value was so

deducted.[89]

(2) Nothing

in paragraph (1) shall prevent the person from recovering any amount

referred to in Article 26C(1) or (2) to the extent to which the amount has

not counted towards an insolvency benefit paid to the person.

(2A) Nothing

in paragraph (2) shall entitle the person to recover an amount

corresponding to any value deducted under Article 26G(1) or (2) or to

recover any amount deducted under Article 26G(3).[90]

(3) The

operation of this Article shall not be affected by the death, or any incapacity,

of the person.

(4) In

this Article and Article 26J –

“count towards” means have

a net positive effect on the amount of an insolvency benefit after any

requirement under Articles 26A to 26H to make a deduction, discount or

other treatment has been complied with;

“person” means a person

who is paid an insolvency benefit;

“recover” means recover

from the relevant employer or from another person, and otherwise than as an

insolvency benefit or as a component of an insolvency benefit.

26J Repayment where employee

recovers some amounts[91]

(1) A

person who recovers any part of an amount referred to in Article 26C(1) or

(2) shall repay the part so recovered to the Social Security Fund to the extent

to which the part has counted towards an insolvency benefit paid to the person.

(2) For

the purposes of this Article, “part” includes all and none.

27 Increase of benefit for

dependants[92]

(1) The

weekly rate of short term incapacity allowance, incapacity pension and parental

allowance shall be increased by the amount set out in the second column of Part 3

of Schedule 1, and the weekly rate of long term incapacity allowance shall

be increased by a percentage of that amount, being the percentage in which the

degree of incapacitation (assessed in accordance with the provisions of Article 16)

is expressed, for any prescribed period during which the beneficiary or any

other prescribed person is caring, in prescribed circumstances, for a person of

a prescribed category.[93]

(2) A

beneficiary shall not be entitled for the same period to an increase in benefit

under paragraph (1) in respect of more than one person.

28 Overlapping benefits, etc.

(1) Provision

may be made by Order –

(a) for adjusting benefit

payable to or in respect of any person, or the conditions for its receipt,

where –

(ai) any pension payable out

of the public funds of Jersey or the public funds of any other country or

territory is payable to or in respect of that person or that person’s wife,

husband or civil partner,

(aii) any payment has been made

under the Income

Support (Jersey) Law 2007, to or in respect of that person, or to or

in respect of a person who is a member of that person’s household for the

purposes of that Law,

(i) any allowance payable out of public funds

(including any other benefit under this Law whether of the same or a different

description) is payable to or in respect of that person or that person’s wife,

husband or civil partner, or

(ii) that person is

undergoing medical or other treatment as an in-patient in a hospital or similar

institution;

(b) for suspending payment of

benefit to a person during any period during which the person is undergoing

such medical or other treatment.[94]

(2) Where

by virtue of an Order made under paragraph (1) benefit payable to or in

respect of any person is adjusted, or the payment of any benefit is suspended,

by reason of the fact that the person is undergoing medical or other treatment

as an in-patient in a hospital or similar institution and such treatment is

provided free of charge to that person, the Minister, in his or her discretion,

may pay out of the Social Security Fund to the authority at whose expense the

treatment is provided the amount of the adjustment or the benefit, as the case

may be.

(3) Where

but for any Order made by virtue of paragraph (1)(a), 2 persons would both

be entitled to an increase of benefit in respect of a third person, provision

may be made by Order as to their priority.

(4) In

this Article, the expression “hospital or similar institution” includes any

institution in which poor persons are lodged and maintained at the cost of a

public or parochial authority.

29 Supplementary provisions

as to benefit

(1) Provision

may be made by Order –

(a) for prescribing the time

and manner in which claims to benefit may be made and the evidence and

information to be supplied in support thereof;

(b) for prescribing the time

and the manner of payment of benefit;

(c) for disqualifying a person

for receiving any benefit or suspending payment thereof during prescribed

periods of absence from Jersey or imprisonment or detention in legal custody;

(d) for prescribing the

circumstances in which a person is or is not to be deemed for the purposes of

this Law to be caring for another person;

(e) for any other matters

incidental to claims for and payment of benefit.[95]

(2) Subject

to the provisions of this Law, benefit shall not be capable of being assigned,

charged or attached, nor shall it pass to any other person by operation of law,

nor shall any claim be set off against the same, except in such cases and

subject to such conditions as may be prescribed.

PART 4

FINANCE, ADMINISTRATION AND LEGAL PROCEEDINGS

30 Social Security Fund

(1) The

Insular Insurance Fund established in pursuance of the Law of 1950 shall

be renamed the Social Security Fund and shall be maintained under the control

and management of the Minister.

(2) Subject

to paragraph (3A), there shall be paid into the Social Security Fund all

contributions payable under this Law after deduction therefrom of the

appropriate Health Insurance Fund Allocation and appropriate Long-Term Care

Fund Allocation, together with monies provided by the States, the proceeds of

all charges imposed under this Law and any amount recovered by virtue of Article 26I(1);

and there shall be paid out of the Fund all claims for benefit, and all

expenses, including salaries, equipment and the provision of accommodation,

incurred by the Minister in carrying this Law into effect.[96]

(3) Subject to paragraph (3A), the appropriate Health Insurance Fund Allocation, which shall be paid

into the Health Insurance Fund, shall be the aggregate of the amounts expressed

in Schedules 1A and 1B to be allocated to that Fund.[97]

(3A) Where

the Class 1 or Class 2 contributions paid in respect of a person are

less than such contributions as are due in respect of the person, the amount to

be paid into the Health Insurance Fund and the balance to be paid into the

Social Security Fund shall be reduced proportionally.[98]

(3B) The

appropriate Long-Term Care Fund Allocation, which shall be paid into the

Long-Term Care Fund, shall be the aggregate of –

(a) the LTC contributions

determined in accordance with Schedule 1C; and

(b) LTC surcharges determined

in accordance with paragraph 4A of Schedule 1D,

and collected in