Education (Grants

and Allowances) (Jersey) Order 2018

Part 1

INTERPRETATION

1 Interpretation[1]

In this Order –

“1961 Law” means the Income Tax (Jersey) Law 1961;

“2023 academic year” means the academic year

beginning on 1 September 2023;

“2024 academic year” means the academic year beginning

on 1 September 2024;

“2025 academic year” means the academic year beginning on 1 September 2025;

“academic year” means a period of 12 months

beginning on 1 September;

“credit” means a unit of

learning that is awarded in recognition of achievement of learning outcomes at

a specified level;

“course” means a

structured series of modules that require study at a particular level, leading

to a qualification;

“degree programme”

means an academic qualification (for example, a bachelor’s or

master’s degree or equivalent), which –

(a) is achieved

by completing courses or modules over time; and

(b) is awarded

by an institution that is authorised by an appropriate body to award degree

qualifications;

“dependent student” is construed in accordance with

Article 2;

“distance learning course” has the meaning in Article 11(3);

“full-time” in relation to a course means a course

published as a full-time course by the institution providing the course or the

Universities and Colleges Admissions Service of the United Kingdom;

“higher education” –

(a) means

a course described in Schedule 2 to the Law; but

(b) does

not include a course at postgraduate level unless provided for by

Article 9 (professional examinations);

“income” is defined in Article 3A;

“independent student” is construed in accordance with

Article 2;

“Law” means the Education (Jersey) Law 1999;

“level”, in respect of a qualification

relating to a course in education, means a qualification level specified in the

Regulated Qualifications Framework for England,

Wales and Northern Ireland or an equivalent framework published by the

government of any other country or territory;

“main

residence” means, in respect of

a student who is resident at more than one address in Jersey, the address at which

the student spends the most time in Jersey or, if the student spends equal time

at more than one address in Jersey, the residential address given in an

application for a grant or allowance;

“module” means a segment

of a course that –

(a) is

self-contained, formally structured and credit bearing; and

(b) has

an explicit set of learning outcomes and assessment criteria;

“parent” has the

meaning given in Article 1(1) of the Children (Jersey) Law 2002;

“part-time” in relation to a course means a course

published as a part-time course by the institution providing the course or the

Universities and Colleges Admissions Service of the United Kingdom;

“published” in relation to a full-time or part-time

course means published in a manner that is likely to bring the information about

the course to the attention of a student including on a website or in a printed

or digital prospectus;

“relevant assets”, in respect of a student and for an

academic year, means the assets, as at the end of the calendar year preceding

the calendar year in which the academic year commences, of the parties whose

incomes are taken into account (and not completely disregarded) in assessing

the relevant income of the student, not including any asset that is a principal

residence of any such party;

“relevant date”, for an academic year, means

31 August immediately preceding the commencement of the academic year;

“relevant income”, in respect of a student and for an

academic year, means the amount determined in accordance with Articles 4,

5, 6, 6A, 12A or the Schedule;

“relevant person” is construed in accordance with Article 5(2);

“resident” is construed in accordance with Article 3;

“student”, in respect of an application for a grant or

allowance, includes a person intending to become a student;

“tuition fees” means all fees payable to an institution

relating to the provision of a course, including fees for admission,

registration, matriculation, tuition, examinations, validation and graduation.

2 Dependent

and independent students[2]

(1) A

student is an independent student in respect of an academic year if, on or

before the relevant date for that year, the student –

(a) is 25

years of age or older;

(b) is

married or in a civil partnership;

(c) has

been living financially independently of the student’s parents for at

least 3 years before the first academic year of the student’s

course;

(d) has

no living parent;

(e) is

the parent of a child of the household; or

(f) is

the subject of an order committing the student to the care of the Minister for

Children and Families made under the Children

(Jersey) Law 2002 or, before attaining full

age, was so subject.[3]

(2) A

student who is not an independent student is a dependent student.

(3) In

this Article –

“child” means a person at or below the

upper limit of compulsory school age;

“child of the household” means, in

relation to a student, any child whose main place of residence is with the

student as part of that student’s household.

3 Meaning of “resident”

(1) An independent student

is resident in Jersey if, on the relevant date for the first academic year of the

student’s course, the student –

(a) is

ordinarily resident in Jersey; and

(b) has

been so resident –

(i) for at least one

year, if the student has Entitled status under the Control of Housing and Work (Jersey)

Law 2012, or

(ii) for

at least 5 years.

(2) Despite paragraph (1),

if the residential qualification set out in that paragraph is not met in

respect of a student solely because the student is or was temporarily employed

outside Jersey, that period of employment may be counted as a period of

ordinary residence in Jersey.

(3) A dependent student is

resident in Jersey if, on the relevant date for the first academic year of the

student’s course, the student and his or her parents –

(a) are

all ordinarily resident in Jersey; and

(b) have

been so resident –

(i) for at least one

year, if any one or more of them has Entitled status under the Control of Housing and Work (Jersey)

Law 2012, or

(ii) for

at least 5 years.

(4) Despite paragraph (3) –

(a) if a

student is ordinarily resident with only one parent, only the ordinary

residence of that parent is taken into account for the purposes of paragraph (3);

and

(b) if

the residential qualification set out in paragraph (3) is not met in

respect of a student solely because a parent is or was temporarily employed

outside Jersey, that period of employment may be counted as a period of

ordinary residency in Jersey for both the parent and the student.

(5) Despite paragraphs (1)

and (3), a student may be regarded as resident in Jersey if it would be unfair

in the circumstances of a particular case not to so regard him or her.

3A Meaning

of “income”[4]

(1) For the purposes of

this Order, “income”, in respect of a person (“first

person”), means the person’s profits, gains, salaries, fees, wages

and perquisites of any kind arising from any source, whether in Jersey or

elsewhere, and includes –

(a) any

income applied by another person, under a trust, for or towards the

maintenance, education, or other benefit, of the first person or of any other

person dependent on or maintained by the first person;

(b) any

amount payable, whether under an order of a court or any agreement, for the

maintenance of the first person or of any other person dependent on the first

person;

(c) any

benefit or bonus or payment (however described) payable to or in respect of the

first person under either of the following Laws, including any Regulations or

Orders made under those Laws –

(i)

(ii) Social Security (Jersey) Law 1974,

(iii) Income Support (Jersey) Law 2007, and

(iv)

(d) deemed

income under paragraphs (2) and (3).[5]

(2) If an individual holds

a relevant interest in an entity during a calendar year for which the

individual’s income is relevant income, the individual is deemed to

receive as income the proportion of the profits made by that entity during that

calendar year that is equivalent to the proportion of the individual’s

relevant interest in that entity.

(3) If that individual

holds that relevant interest for part only of that calendar year, the amount

that the individual is deemed to receive as income is apportioned to reflect

the portion of the year in which the individual held the relevant interest.

(4) In this Article, a

“relevant interest” means a holding of 5% or greater

of –

(a) the

share capital, for a company incorporated under the Companies (Jersey) Law 1991;

(aa) the LLC interest,

for a limited liability company registered under the Limited

Liability Companies (Jersey) Law 2018;

(b) the

partnership interest, for –

(i) an incorporated

limited partnership formed under the Incorporated Limited Partnerships (Jersey)

Law 2011,

(ii) a

limited liability partnership formed under the Limited Liability Partnerships (Jersey)

Law 2017,

(iii) a

limited partnership formed under the Limited Partnerships (Jersey) Law 1994, or

(iv) a

separate limited partnership formed under the Separate Limited Partnerships (Jersey)

Law 2011.[6]

4 Meaning

of relevant income of dependent student

(1) This Article applies

where –

(a) a

dependent student does not live in his or her main residence in Jersey with a

parent and a relevant person; or

(b) a

dependent student lives in his or her main residence in Jersey with a parent

and a relevant person and that parent and the student’s other parent have

agreed that the student’s relevant income should be determined in

accordance with this Article.

(2) The relevant income in

respect of a dependent student for an academic year is the gross income of the

student’s parents for the calendar year preceding the calendar year in

which the academic year commences.

(3) If a parent dies during

an academic year, the amount of that parent’s income taken into

consideration for the academic year is reduced by a portion equivalent to the

unexpired portion of the academic year.

(4) If, as the result of an

event beyond the control of the parents, the parents’ income for the

calendar year in which the academic year for the course commences is likely to

be 80% or less of their income for the preceding calendar year, the relevant

income of the student may be determined by reference to the parents’

gross income for the calendar year in which the academic year for the course

commences.

(5) The income of a parent is

disregarded if –

(a) the

parent dies before the commencement of the academic year;

(b) the

parent cannot be found, or it is not reasonably practicable to get in touch

with the parent; or

(c) the

student is the subject of any order committing the student to the care of the Minister

for Children and Families made under the Children (Jersey) Law 2002 or, before attaining full

age, was so subject.[7]

(6) The whole or any part

of the income of a parent may be disregarded if the family circumstances of the

student are such that it would be unfair to the student not to do so.

(7) Where Article 6A

(meaning of relevant income of certain dependent students living with a single

parent) applies, this Article has effect with the modifications specified in

Article 6A(5).[8]

5 Meaning

of relevant income of dependent student living with “relevant person”

(1) This Article applies in

the case of a dependent student who lives in his or her main residence in

Jersey with a parent and a relevant person unless Article 4(1)(b) applies.

(2) A “relevant

person” is, for the purposes of Article 51(e)(iii) of the Law

(grants and loans), a person who –

(a) is

not a parent of the dependent student;

(b) is

married to, or is in a marriage-like relationship with that student’s

parent or has formed a civil partnership, or is in a civil partnership-like

relationship with that student’s parent; and

(c) is living

with a parent of that student.

(3) The relevant income for

an academic year in respect of a dependent student is the sum of the gross income

of the student’s parent and the gross income of the relevant person for

the calendar year preceding the calendar year in which the academic year commences.

(4) For the purposes of

determining a relevant person’s income, there is deducted any amount

payable by the relevant person, whether pursuant to an order of a court or any

other agreement, for the maintenance of any person dependent on the relevant person.

(5) In paragraph (4)

the reference to “any person dependent on the relevant person” does

not include the dependent student to whom this Article applies or the parent with

whom he or she is living.

(6) If the relevant person

dies during the academic year, the amount of that person’s income which

has been applied for the purposes of calculating the dependent student’s

relevant income for an academic year under paragraph (3), is reduced by a

portion equivalent to the unexpired portion of that academic year.

(7) The income of a

relevant person is disregarded if –

(a) the

relevant person dies before the commencement of the academic year; or

(b) the

student is the subject of any order committing the student to the care of the Minister

for Children and Families made under the Children (Jersey) Law 2002 or, before attaining full

age, was so subject.[9]

6 Meaning

of relevant income of independent student

(1) The relevant income in

respect of an independent student for an academic year is the sum of –

(a) the

student’s gross income for the calendar year in which the academic year

starts; and

(b) if –

(i) the student is

married, the student’s spouse’s gross income for the calendar year

in which the academic year starts,

(ii) the

student is in a civil partnership, the student’s civil partner’s

gross income for the calendar year in which the academic year starts, or

(iii) the

student is living with a partner in a marriage-like relationship or a civil partnership-like

relationship, the student’s partner’s gross income for the calendar

year in which the academic year starts.

(2) But the income of a

student’s spouse, civil partner or partner is not taken into account

during any part of the calendar year that the student is not –

(a) married

or in a civil partnership; or

(b) living

in a marriage-like relationship or in a civil partnership-like relationship.[10]

(3) The whole or any part

of the income of a student or of their spouse, civil partner or partner may be

disregarded if the student’s family circumstances mean that it would be

unfair to the student not to do so.[11]

6A Meaning

of relevant income of certain dependent students living with a single parent [12]

(1) This Article applies

where –

(a) a

dependent student lives with a single parent;

(b) an

application for a grant for a course is made, in respect of the student, for an

academic year beginning on or after 1st September 2022 (the “grant

application year”);

(c) the

student was eligible under Part 2 for consideration for, and had applied for, a

grant in respect of that course (whether or not the grant was

awarded) –

(i) in the 2021

academic year, and

(ii) where

the grant application year begins on or after 1st September 2023, in each other

academic year beginning on or after 1st September 2022 but preceding the grant

application year;

(d) the Education (Grants and Allowances) (Academic Year

2021-2022) (Jersey) Order 2021 applied for the purposes of determining the relevant income of the

dependent student for the 2021 academic year; and

(e) none

of the circumstances mentioned in sub-paragraphs (a) to (c) of

Article 29 have arisen in relation to the student and the course.

(2) For

the purposes of paragraph (1)(a) a student “lives with a single

parent” if –

(a) the

student lives in their main residence in Jersey with one parent (the

“single parent”); and

(b) no

other parent or relevant person also lives in that main residence.

(3) Two different courses

in higher education that would together lead to a single qualification are to

be treated, for the purposes of paragraph (1), as if they were the same

course.

(4) Where this Article

applies, the relevant income in respect of the dependent student for the grant

application year is the single parent’s gross income for the calendar

year preceding the calendar year in which the grant application year begins.

(5) Article 4 has

effect in relation to the dependent student with the following

modifications –

(a) paragraph (2)

is disregarded (and paragraph (4) of this Article applies instead);

(b) paragraphs (3)

to (6) have effect as if each reference (however expressed) to a parent, or the

parents, of the dependent student were a reference to the single parent.

(6) In this Article,

“2021 academic year” means the academic year beginning on 1st

September 2021.

6B Status

of examples[13]

(1) An example provided in

this Order is part of the text of the Order.

(2) But an example does not

limit the provisions to which it relates.

Part 2

ELIGIBILITY FOR GRANT

7 General

rules for eligibility

(1) A student is not

eligible for consideration for a grant under this Part unless –

(a) the

student is resident in Jersey; and

(b) on

the relevant date for the first academic year of the course to be undertaken by

the student, the student is over compulsory school age.

(2) A student who has

undertaken the whole or part of a course for which a grant is available is not

eligible to be considered for a grant of the same description in respect of

another course at or beneath the level of the original course whether or not

the student received a grant for the original course or part of it.

8 Eligibility

for higher education grant[14]

(1) A student is eligible

for consideration for a grant for a full-time or part-time course in higher

education if the institution providing the course confirms that the student has

been offered a place on the course.

(2) A student is not

eligible for consideration for a grant under this Article if the student has

previously received –

(a) a

grant under Article 9 (professional

examinations); or

(b) a

grant under Article 11 (distance learning).

(3) A student is eligible

for consideration for a grant for a full-time or part-time course in higher

education only if –

(a) in

the opinion of the Minister, the educational provision is of a suitable

standard; and

(b) the

qualification is awarded by an institution regulated by the appropriate body

designated for that purpose by the government in the country

or territory in which the institution is established.[15]

(4) When determining whether a student is eligible for

consideration for a grant for a course in higher education, the Minister

may do any of the following –

(a) consider

the outcome of an assessment or rating applied to the institution by the

appropriate body designated for that purpose by the government in the country

or territory in which the institution is established;

(b) if a

course is not delivered in the British Islands, require the student to provide

evidence of the regulated status or qualification level of the course in order

for the student to be considered for a grant.[16]

8A Exception

to non-eligibility for a grant in respect of certain courses[17]

(1) This Article applies to

a student who is not eligible for consideration for a grant by virtue of

Article 7(2) or under Article 8 but who –

(a) in

respect of an academic year preceding the 2023 academic year, was

undertaking a course provided by an institution specified in the table in

paragraph (2) and is enrolled or intends to be enrolled on the same course

for the 2023 academic year; or

(b) in

respect of the 2023 academic year, has been offered a place on a course

provided by an institution specified in the table in paragraph (2).

(2) A student is eligible

for consideration for a grant in respect of the 2023 academic year of a

course specified in the table and each subsequent academic year of that

course –

|

|

|

|

|

1

|

Bachelor of Arts (Hons) Social Work

(Jersey)

|

University of Plymouth partnered with Highlands College

|

|

2

|

Bachelor of Arts (Hons) Social Work

(Jersey)

|

University of Sussex partnered with Highlands College

|

|

3

|

Bachelor of Nursing (Hons) Adult Nursing

|

University of Chester partnered with the relevant States body

|

|

4

|

Bachelor of Nursing (Hons) Mental Health

Nursing

|

University of Chester partnered with the relevant States body

|

|

5

|

Bachelor of Science/Bachelor of Science (Hons) Nursing –

Adult

|

Robert Gordon University partnered with the relevant States body

|

|

6

|

Bachelor of Science/Bachelor of Science (Hons) Nursing –

Mental Health

|

Robert Gordon University partnered with the relevant States body

|

|

7

|

Bachelor of Science/Bachelor of Science (Hons) Nursing –

Children and Young People

|

Robert Gordon University partnered with the relevant States body

|

|

8

|

Bachelor of Science Midwifery

|

Robert Gordon University partnered with the relevant States body

|

(3) In this Article “relevant

States body” means a States body as defined by the Public Finances (Jersey) Law 2019 responsible for

discharging functions relating to health.

9 Professional

examinations

(1) A student is eligible

for consideration for a grant in respect of a full-time course of postgraduate

education in preparation for a professional examination at a higher level.

(2A) A student who has previously received

a grant under Article 11 is eligible for consideration for a grant under

this Article.[18]

(2) For

the purpose of paragraph (1), a professional examination is at a higher

level if its standard is higher than the standard of examinations at advanced

level for the General Certificate of Education or the examination for the

National Certificate or the National Diploma.[19]

10 Vocational

arts[20]

A student is eligible for consideration for a grant for a one year

full-time course at level 3 in an arts-related subject in the British Islands

provided that the student has not previously been awarded a grant for a course

under this Part.

11 Distance

learning

(A1) The

Schedule (distance learning courses) makes provision about grants for students

undertaking distance learning courses.[21]

(A2) For clarity, Articles 4 to 6A and

13 to 13CA do not apply to students undertaking distance learning courses.[22]

(1) A student is eligible

for consideration for a grant in respect of a distance learning course, of an

amount calculated in accordance with the Schedule.[23]

(2) A student is not

eligible for consideration for a grant under this Article if the student has

already been awarded a grant for a course in higher education under this Part.

(3) A “distance

learning course” is a course in respect of which an

institution does not require a student to attend a particular place for its

provision.[24]

Part 3

AMOUNT OF GRANT

12 Interpretation

(1) In this

Part –

“clinical component grant” means a grant for an academic

year awarded under Article 15;

“maintenance grant” means a grant for an academic year,

awarded under Article 13B, 13BA, 13C or 13CA for the purposes of assisting

a student to pay for their living costs incurred while undertaking a course that is not a distance learning course;

“tuition fees grant” means a grant for an academic year awarded

under Article 13 for the payment of tuition fees.[25]

(2) In this Part,

“student’s category” means the category assigned to a student

according to the student’s description in the following

table –

|

|

|

|

Dependent student undertaking a course

elsewhere than in Jersey

|

A

|

|

Dependent student undertaking a course in

Jersey

|

B

|

|

Independent student undertaking a course in Jersey or elsewhere

|

C[26]

|

12A Relevant assets

exceeding £500,000 [27]

For the purposes of

awarding a tuition fees grant, a maintenance grant or a clinical component

grant, if the value of a student’s relevant

assets is more than £500,000, the student’s relevant income

is –

(a) £200,000

or more for a grant awarded for the 2024 academic year;

(b) £210,400

or more for a grant awarded for the 2025 academic year or a subsequent academic

year.

13 Tuition

fees grant[28]

(1) A

dependent student or an independent student may be awarded a

tuition fees grant for a course that is not a distance learning course, whether

the course is undertaken in Jersey or elsewhere.

(2) [29]

(3) For the 2025 academic year, and subsequent

academic years, the amount of tuition fees grant that may be awarded to a

student is as follows[30] –

|

|

|

|

Less than 115,720

|

9,535

|

|

115,720 or more but less than 126,240

|

8,583

|

|

126,240 or more but less than 136,760

|

7,629

|

|

136,760 or more but less than 147,280

|

6,676

|

|

147,280 or more but less than 157,800

|

5,722

|

|

157,800 or more but less than 168,320

|

4,768

|

|

168,320 or more but less than 178,840

|

3,815

|

|

178,840 or more but less than 189,360

|

2,861

|

|

189,360 or more but less than 199,880

|

1,907

|

|

199,880 or more but less than 210,400

|

954

|

|

210,400 or more

|

0

|

(4) [31]

13A [32]

13B [33]

13BA 2025 academic year: maximum

maintenance grant if relevant income is less than £52,600 [34]

For the 2025 academic year,

a student whose relevant income is less than £52,600 may be awarded the

maximum maintenance grant specified in the following table –

13C [35]

13CA 2025 academic year:

maintenance grant if relevant income is £52,600 or more, but less than £94,680 [36]

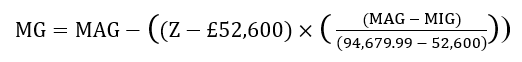

(1) This

Article applies only to a maintenance grant awarded for the 2025 academic year.

(2) A

student whose relevant income is £94,679.99 may

be awarded the minimum maintenance grant specified in the table –

(3) A

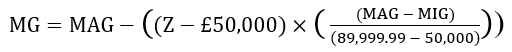

student whose relevant income is £52,600 or more, but less than

£94,679.99, may be awarded a maintenance grant (“MG”) of an

amount calculated using the following formula –

(4) In

the formula –

“MAG” means the

maximum maintenance grant that would be awardable if Article 13BA applied to

the student instead of paragraph (3);

“MIG” means the

minimum maintenance grant that would be awardable if paragraph (2) applied

to the student instead of paragraph (3);

“Z” means the

student’s relevant income.

(5) For

example, the maintenance grant (“MG”) for the 2025 academic year

awarded to a dependent student who is undertaking a course outside of Jersey

(category A), and who has a relevant income of £65,000, would be

calculated as follows –

13CB Student detained in prison not

entitled to maintenance grant[37]

(1) A

student who is detained in prison is not entitled to a maintenance grant during

their detention.

(2) In

this Article, “prison” has the meaning given in Article 1(1)

(interpretation) of the Prison

(Jersey) Law 1957.

13D London component

increase[38]

(1) This

Article applies if a student is –

(a) undertaking

a course at an institution located in London; and

(b) awarded

a maintenance grant.

(2) If

this Article applies, the student’s maintenance grant is increased by 10%.

(3) If

a student is also awarded a clinical component grant or

an allowance under Part 4, the percentage increase specified in

paragraph (2) must not be applied to that grant or allowance.[39]

(4) The

location of a student’s accommodation is immaterial for the purposes of

this Article.

(5) An

institution is located in London if it is situated within a postcode contained

in a publication, issued by the UK Office for National Statistics, setting out

postcode areas for London.

14 Clinical

courses

(1) In this

Article –

“clinical year” means an academic year that forms part

of a course in medicine, dentistry, veterinary science, or a related subject

and includes a period of study by way of clinical training;

“non-clinical year” means a year that is not a clinical

year.

(2) For a clinical year of

a course falling within paragraph (3), the amount of grant that may be

made to a student in respect of tuition fees is such amount as the Minister

considers appropriate, provided that it is not less than the tuition fees grant.[40]

(3) A course falls within

this paragraph if –

(a) at

least one clinical year and at least one non-clinical year form part of the

course;

(b) the

actual cost of tuition fees for a non-clinical year exceeds the tuition fees

grant; and

(c) the

actual cost of tuition fees for a clinical year exceeds the tuition fees grant

by an amount which appears disproportionate to the Minister in relation to any

other course in medicine, dentistry, veterinary science or a related subject.[41]

(4) For a clinical year of

a course that does not fall within paragraph (3), the tuition fees grant

is increased to the actual cost of tuition fees for that year.[42]

15 Clinical

component grant[43]

(1) This

Article applies if –

(a) a

student is undertaking a course in medicine, dentistry, nursing or veterinary

science; and

(b) the

student’s relevant income is –

(i) less than

£100,000 for a grant awarded for the 2024 academic year; or

(ii) less

than £105,200 for a grant awarded for the 2025 academic year or for a

subsequent academic year.[44]

(2) The student may be

awarded the clinical component grant specified in the following table[45] –

|

|

|

|

|

A

|

1,189

|

1,219

|

|

B

|

1,111

|

1,139

|

|

C

|

1,189

|

1,219

|

16 Arts

foundation courses[46]

The tuition fees grant for a one year full-time course at

level 3 in an arts-related subject is limited to the actual cost of

tuition fees for an equivalent course provided by Highlands College.

17 [47]

18 [48]

19 Reduction

of grant to take account of child allowance

(1) In this

Article –

(a) “Article 95(1)(b)

or (2)” means Article 95(1)(b) or (2) (children) of

the 1961 Law;

(b) “entitlement”

means, subject to paragraph (2), a person’s entitlement in a

relevant year in respect of a relevant student to an exemption threshold

increase and deduction under Article 95(1)(b) or (2), including

entitlement under any other provision in the 1961 Law which arises by

virtue of an entitlement under Article 95(1)(b) or (2);

(c) “relevant

student” means a dependent student for an academic year in respect of

which an application for a grant is made;

(d) “relevant

year” means the calendar year for which the relevant income in respect of

the relevant student is calculated under this Order;

(e) “person A”

means a person who, for all or part of a relevant year, has an entitlement.

(2) For the purposes of

paragraph (1)(b) a person’s entitlement does not

include –

(a) entitlement

which the person has relinquished under Article 95(2) of

the 1961 Law;

(b) any

portion of that entitlement to which another person is entitled following

apportionment under Article 95 of the 1961 Law; or

(c) entitlement

which arises under Article 98A of the 1961 Law (additional allowance

in respect of children).

(3) Paragraph (4)

applies if –

(a) person A

is a relevant person who is married to or in a civil partnership with the

student’s parent and the student’s relevant income is calculated

under Article 4 or 5;

(b) person A

is a relevant person who –

(i) is

not married or in a civil partnership with the student’s parent,

(ii) lives

in the student’s main residence in Jersey,

and the student’s relevant income is calculated under Article 5;

(c) person A

is a parent of the student and the student’s relevant income is

calculated under Article 4;

(d) person A

is a parent of the student who lives with the student in the student’s

main residence in Jersey and the student’s relevant income is calculated

under Article 5.

(4) Subject to paragraph (7),

the tuition fees grant payable to a dependent student is reduced by

A – B where –

(a) A is

the amount of person A’s tax liability for a relevant year calculated

without taking into account the amount of person A’s entitlement;

(b) B is

the amount of person A’s tax liability for a relevant year

calculated taking into account the amount of person A’s entitlement.[49]

(5) If more than one person

meets a description of person A in respect of a student, the tuition fees

grant payable to the student is reduced by each amount calculated under

paragraph (4) in respect of each person A.[50]

(6) [51]

(7) Where the amount of

A – B under paragraph (4) is greater than the tuition fees

grant, the tuition fees grant is £0.[52]

20 Reduction

of grant in respect of 4-year courses[53]

(1) This Article applies in

respect of a 4-year full-time course in higher education where an equivalent 3-year

full-time course may be undertaken instead.[54]

(2) This Article does not

apply in respect of –

(a) a 4-year

full-time course where for one year of the course the student is required to

attend a place other than the institution at which the student is required to

attend for the other 3 years of the course; or

(aa) a 4-year

full-time course that began before the 2024 academic year;

(b) [55]

(3) If this Article

applies, the amount of tuition fees grant or maintenance grant awardable to a

student are each reduced by 25%.[56]

(4) The 25% reduction

in the amount of tuition fees grant must be applied to the amount of the

tuition fees grant after a reduction, if any, is applied under Article 19.[57]

20A Reduced

maintenance grant in respect of part-time courses[58]

(1) This Article applies if

a student is –

(a) undertaking

a part-time course; and

(b) awarded

a maintenance grant.

(2) But, this Article does

not apply if a student is –

(a) undertaking

a part-time course that began in respect of an academic year that preceded the

2023 academic year; and

(b) eligible

for consideration for a grant in respect of the 2023 academic year of that

part-time course and each subsequent academic year of that course.

(3) If this Article

applies, because the course is not a full-time course, a percentage of the full

amount of the maintenance grant is awardable instead.

(4) The percentage of the

full amount of the maintenance grant is calculated by reference to

the number of years the full-time course would take to complete as an

equivalent part-time course, as set out in the table –

|

|

|

|

|

1

|

2

|

50%

|

|

2

|

3

|

67%

|

|

2

|

4

|

50%

|

|

3

|

4

|

75%

|

|

3

|

5

|

60%

|

|

3

|

6

|

50%

|

|

4

|

5

|

80%

|

|

4

|

6

|

67%

|

|

4

|

7

|

57%

|

(5) For the calculation of

the percentage amount of maintenance grant awardable in respect of a course of

a length not set out in the table, the percentage is calculated by dividing the

length of the full-time course in years by the length of the equivalent

part-time course in years.

(6) An increase under

Article 13D (London component increase), if any, is to be applied after

the calculation has been made of the percentage amount of maintenance grant

awardable.

(7) A clinical component

grant is awardable in full even if it is awarded in respect of a part-time

course.[59]

(8) In this Article

“full amount of the maintenance grant” means the amount of the

maintenance grant awardable under Article 13B, 13BA, 13C or 13CA.[60]

Part 4

ALLOWANCES

21 Skills

bursary allowance

(1) A

student is eligible for consideration for an allowance in respect of a

full-time course in a place other than in Jersey if –

(a) on

the relevant date for the first academic year of the course to be undertaken by

the student, the student has not attained 19 years of age;

(b) either –

(i) an equivalent

course is not available in Jersey, or

(ii) an

equivalent course is available in Jersey and –

(A) it is a

requirement of the institution providing the course outside Jersey that the

student receives training for the development of a skill or takes part in other

opportunities for such development, and

(B) the

equivalent of such training or opportunities is not available in Jersey; and

(c) upon

successful completion of the course the student will gain a level 2

or 3 qualification.

(d) the

duration of the course does not exceed 2 years.[61]

(2) The

allowance payable under this Article is £6,675 per academic year.

22 Interview

attendance allowance

(1) A student may be paid

an allowance to attend an interview for a course of higher education.

(2) A student must not be

paid more than one interview attendance allowance.

(3) The amount paid is

repayable as a debt if a student –

(a) is

paid an interview attendance allowance; and

(b) is

subsequently found not to be eligible to be awarded a grant for that course by

reason of relevant income.

(4) The interview attendance

allowance for a student is the actual travel costs to be incurred by the

student for the purposes of attending the relevant interview, subject to a

maximum of £258.

(5) However, the interview

attendance allowance is £0 where –

(a) the

student’s relevant income is –

(i) £50,000 or

more for an interview attendance allowance awarded for the 2024 academic year;

or

(ii) £52,600

or more for an interview attendance allowance awarded for the 2025 academic

year or a subsequent academic year; or

(b) the

relevant assets in respect of the student exceed £500,000.[62]

23 Disabled

student allowance

(1) A student with a

disability may be paid a disabled student allowance if the student meets the

requirements of Article 7(1) and is eligible for consideration

for –

(a) a grant

under Article 8 or 8A; or

(b) an

allowance under Article 21.[63]

(2) Subject to paragraphs (4)

to (7), the allowance may be awarded in respect of all or part of any costs

that are referred to in paragraph (3) and are incurred by the student, by

virtue of his or her disability, to attend and undertake his or her course

(regardless of whether he or she has been awarded a grant or allowance for it).

(3) The costs

are –

(a) the

costs of the services of a non-medical helper;

(b) the

cost of purchasing or hiring specialist equipment; and

(c) any

other reasonable costs, other than travel costs.

(4) The allowance in

respect of the costs of the services of a non-medical helper is the amount of

the actual costs subject to a maximum amount equivalent to the costs for

providing such services for an hour during each week of the course.

(5) The maximum amount

referred to in paragraph (4) may be waived in exceptional circumstances

where the Minister thinks it appropriate to do so.

(6) The allowance for the

cost referred to in paragraph 3(b) is payable only if the student’s

relevant income is –

(a) less

than £90,000 for an allowance awarded for the 2024 academic year; or

(b) less

than £94,680 for an allowance awarded for the 2025 academic year or a

subsequent academic year.[64]

(7) The allowance for the

costs of purchasing or hiring specialist equipment is the amount of the actual

costs subject to a maximum of £5,151.

24 Vacation

study allowance

(1) A student who has been

awarded a grant for a course in higher education may be paid a vacation study

allowance if paragraph (2) applies.

(2) This paragraph applies

if the institution providing the course in respect of which the grant was

awarded confirms that attendance outside term time at that institution or

another institution is a requirement for all students attending the course.

(3) The amount of the

allowance must not exceed –

(a) £18.11

a day if the institution attended by the student outside term time is in the

British Islands; or

(b) £22.24

a day if it is elsewhere.

(4) An allowance must not

be paid under this Article unless –

(a) an

application that complies with Article 26 (Applications for grants and

allowances) has been made for the allowance before the student attends for the

vacation study; or

(b) the

student satisfies the Minister that there is an exceptional reason why an

application that complies with Article 26 has not been made before that

time.

25 Field

trip allowance

(1) A student who has been

awarded a grant for a course in higher education may be paid an allowance if

paragraph (2) applies.

(2) This paragraph applies

if –

(a) the

student attends during term time a place for a specific purpose designed to

enhance the benefit of the course (attendance by such a student being referred

to in this Article as a “field-trip”);

(b) the

place referred to in sub-paragraph (a) is other than at the institution

providing the course in respect of which the grant was awarded;

(c) the

institution providing the course in respect of which the grant was awarded

confirms that it is not a requirement for all students attending the course to

participate in the field-trip.

(3) The amount of the

allowance must not exceed, for each day that the student does so attend,

whichever is the lower of –

(a) £18.11

a day if the place is in the British Islands, or £22.24 a day if it is

elsewhere; or

(b) the

amount reasonably incurred by the student as expenses in attending the field

trip, that are in addition to the expenses incurred by the student in attending

his or her course.

(4) An allowance must not

be paid under this Article unless –

(a) an

application that complies with Article 26 (applications for grants and

allowances) has been made for the allowance before the student attends the

field trip; or

(b) the

student satisfies the Minister that there is an exceptional reason why an

application that complies with Article 26 has not been made before that

time.

Part 5

GENERAL PROVISIONS FOR GRANTS AND ALLOWANCES

26 Applications

for grants and allowances

(1) An application for a

grant or an allowance must be made –

(a) in

the case of a dependent student, by the student’s parents or, where the

student is ordinarily resident with one parent, that parent;

(b) in

the case of an independent student, by the student; and

(c) not

later than 31st December of the academic year to which the application

relates.

(2) An application for a

grant or an allowance must be accompanied by –

(a) proof

of eligibility for consideration for the grant or allowance;

(b) subject

to paragraph (3) details of relevant income and relevant assets; and

(c) in

the case of an application for a disabled student allowance, medical evidence

in respect of the disability, such evidence having been obtained by a person

authorized by an administration of the States for which the Minister is assigned

responsibility; and

(d) such

evidence as the Minister requires to determine any question connected to an

application by a parent of a dependent student who is living with a relevant

person.

(3) The details of relevant

income and relevant assets referred to in paragraph (2)(b) must be

submitted in such form as the Minister may require by not later than

31st March of the academic year to which the application relates.

(4) Consideration of an

incomplete application must be suspended until all the necessary supporting

evidence has been supplied.

(5) A student may be

required to produce evidence of expenditure for which a grant or allowance has

been, or is to be, awarded or paid.

(6) If –

(a) a

person provides information to establish the eligibility of a student for

consideration for a grant or an allowance, or to calculate the amount of a

grant or an allowance; and

(b) the

facts on which the information was based change so that the information is no

longer accurate,

the person must, as soon as practicable, provide details of the

change together with such other evidence of the change as the Minister

requires.

(7) If an application for a

grant or an allowance is refused in whole or in part, the applicant must be

given written notice of the reasons for the refusal.

27 Information

provided by the Comptroller of Taxes

(1) The Comptroller of

Taxes may use information held by him or her under the 1961 Law for

the purpose of calculating the amount of any reduction required under Article 19

(reduction of grant to take account of child allowance).

(2) The Comptroller of

Taxes may disclose to the Minister information relating to that calculation and

any other information held by the Comptroller of Taxes under the 1961 Law

for the purpose of enabling the Minister to ascertain or verify the correct

amount of a grant or allowance that may be awarded under this Order, including

enabling the Minister to verify the accuracy of any information provided by an

applicant to the Minister under Article 26.

28 Period

of grant or allowance

(1) An award of a grant or

the payment of an allowance normally ends when the course to which it relates

would ordinarily be completed.

(2) However, a grant or an

allowance may be transferred from one course to another.

(3) A transfer from one

course to another means –

(a) a

transfer from one course to another where both courses are run by the same

institution; or

(b) a

transfer from a course run by one institution to the same course run by another

institution.

(4) Paragraph (5)

applies where –

(a) a

grant or an allowance is transferred from one course to another course; and

(b) all

or any part of the course from which the student has transferred is not treated

by the institution running the second course as forming part of the second

course.

(5) The student is not

eligible for the grant or allowance in respect of the duration of all or any

part of the first course that does not form part of the second course.

(6) Despite paragraph (1),

an award of a grant or the payment of an allowance may be extended

if –

(a) because

of ill health or other extenuating circumstances, the student does not complete

the course within the period ordinarily required; and

(b) sufficient

evidence of the ill health or the extenuating circumstances is provided to the

Minister.

(7) A grant or allowance

may be suspended or deferred if –

(a) the

institution running the course allows the student to suspend or defer the

course for a continuous period not exceeding 2 years; and

(b) the

student or the institution notifies the Minister in writing of the suspension

or deferral of the course.

(8) The suspension or

deferral under paragraph (7) may continue until whichever is the soonest

of the following –

(a) the

date on which the student resumes the course, when the grant or allowance may

be reinstated, with the period of suspension or deferral being disregarded for

the purpose of paragraph (1);

(b) the

date on which the grant or allowance is withdrawn or stopped under Article 29,

or is withdrawn under Article 33; or

(c) the date

2 years after the start of the suspension or deferral, when the grant or

allowance may be withdrawn or stopped.

29 Withdrawal

of grant or allowance in cases of failure etc.[65]

(1) If a grant has been

awarded or an allowance has been paid to a student in respect of a course or

module, that grant or allowance is withdrawn or stopped if –

(a) the

student abandons the course;

(b) the

student fails all or part of the course; or

(c) the institution

providing the course refuses to allow the student to complete it.

(2) A grant or allowance

withdrawn or stopped under paragraph (1) is repayable under the terms of

the undertaking given under Article 31.

(3) But if a grant or

allowance is withdrawn or stopped under paragraph (1)(a), the portion of

the grant or allowance relating to a course, or part of a course, that the

student has successfully completed is not repayable.

(4) A student is considered

to have successfully completed a course or part of a course only if they can

provide evidence of completion in the form of an academic transcript or

equivalent issued by the institution providing the course.

30 Payment

of grant or allowance

A grant or an allowance in respect of a course may be the subject of

any of the following –

(a) payment

in instalments;

(b) provisional

payment pending determination of the amount payable to the student for an

academic year;

(c) payment

to the institution providing the course.

31 Undertaking

to repay grant or allowance

(1) An award of a grant or

the payment of an allowance in respect of a course must not be made until the

student or, where the student is under the age of 18, one of the

student’s parents, gives a written undertaking –

(a) to

repay any overpayment of the grant or allowance; and

(b) to

repay the whole or any part of the grant or allowance if it is withdrawn or

stopped under Article 29; or

(c) to

repay, if required, the whole or any part of the grant or allowance if it

is –

(i) withdrawn or

stopped under Article 28(8)(c), or

(ii) withdrawn

under Article 33.

(2) An undertaking to repay

a grant or allowance may be waived if sufficient evidence of the

student’s ill health or other extenuating circumstances is provided.

32 Reduction

of grant or allowance where not in full-time attendance

(1) This Article applies

if, for any part of an academic year, in respect of a full-time course, a

student is not in full-time attendance –

(a) at

the institution at which the relevant course is undertaken; or

(b) at

any other place that the student is required, by that institution, to attend.

(2) The amount of any grant

or allowance that would otherwise be payable to the student must be reduced by

a portion equivalent to the portion of the academic year for which the student

is not in full-time attendance.

33 Grant

or allowance may be suspended or withdrawn

(1) At any time after a

grant has been awarded or an allowance has been paid to a student in respect of

a course, that grant or allowance may be suspended or withdrawn if –

(a) it

appears to the Minister that any evidence, document or information required

under Article 26 (applications for grants and allowances) is inaccurate,

false or misleading, and is connected with an attempt by any person to mislead

the Minister in relation to his or her decision to award the grant or pay the

allowance;

(b) the

student is temporarily excluded from a course by the institution running it, or

is absent from a course without the permission of the institution; or

(c) details

of a change required to be provided under Article 26(6) in respect of the

student have not been provided.

(2) Where a grant is

suspended or withdrawn under paragraph (1), the grant or allowance may be repayable

under the terms of the undertaking given under Article 31.

34 Appeals

panel

(1) There is established a

panel to hear and determine appeals against decisions made under this Order.

(2) Its members

are –

(a) the

Chief Officer, or an officer nominated by the Chief Officer, in an

administration of the States for which the Minister is assigned responsibility;

(b) the

Minister or a person nominated by the Minister; and

(c) a

person, nominated by the Minister, who is independent of any administration of the

States for which the Minister has been assigned responsibility.

(3) When hearing an appeal

the panel must not include a person involved in making the decision appealed

against.

(4) A person aggrieved by a

decision made under this Order may appeal to the panel against the decision.

(5) An appeal under

paragraph (4) may only be made if either or both of the following are

disputed –

(a) the

facts upon which the decision was based; or

(b) the

law applied in reaching the decision.

(6) The appeal –

(a) must

be made in writing; and

(b) must

be made within 2 months after the student is informed of the decision, or

within such further period as the panel may allow having regard to the

circumstances.

(7) The panel

may –

(a) confirm

the original decision;

(b) quash

the decision; or

(c) substitute

for the decision any decision that could have been made under this Order.

Part 6

Repeals, Transitional and Savings provisions and closing

35 [66]

36 [67]

37 Citation

This Order may be cited as the Education (Grants and Allowances)

(Jersey) Order 2018.

Schedule[68]

(Article 11)

Distance learning courses

1 Scope

of Schedule

This Schedule applies if –

(a) a

student is undertaking a distance learning course; and

(b) an

application for a grant for that course is made, in respect of the student, for

an academic year beginning on or after 1 September 2025.

2 Interpretation

of Schedule

In this Schedule –

“credit accumulation and

transfer” means a system that –

(a) enables

a student to accumulate credits;

(b) facilitates

the transfer of a student’s credits within and between higher education

providers; and

(c) is

specified in the Higher Education Credit Framework for England or an equivalent

framework published by the government of any other country or territory;

“student’s category” means the category assigned

to a student according to the student’s description in the following

table –

|

|

|

|

Dependent student undertaking a distance learning course

|

D

|

|

Independent student undertaking a distance learning course

|

E

|

3 Meaning

of relevant income of dependent student

(1) This paragraph applies

if –

(a) a dependent student does not live with a parent and a

relevant person in the student’s main residence in Jersey; or

(b) a dependent student lives with a parent and a relevant

person in the student’s main residence in Jersey, and that parent and the

student’s other parent have agreed that the student’s relevant

income should be determined in accordance with this paragraph.

(2) The relevant income in

respect of a dependent student for an academic year is the gross income of the student’s

parents for the calendar year preceding the calendar year in which the student’s

first module of the academic year commences.

(3) If a parent dies during

an academic year, the amount of their income that has been applied for the

purposes of calculating the dependent student’s relevant income for the

academic year is reduced by a portion equivalent to the unexpired portion of

that academic year.

(4) If, as the result of an

event beyond the control of the parents, the parents’ income for the

calendar year in which the student’s first module of the academic year

commences is likely to be 80% or less of their income for the preceding

calendar year, the relevant income of the student may be determined by

reference to the parents’ gross income for the calendar year in which the

module commences.

(5) The income of a parent

is disregarded if –

(a) the

parent dies before the student’s first module of the academic year

commences;

(b) the

parent cannot be found, or it is not reasonably practicable to contact the

parent; or

(c) the

student is the subject of an order committing the student to the care of the

Minister for Children and Families made under the Children (Jersey) Law 2002 or

was the subject of an order before attaining full age.

(6) The whole or any part

of the income of a parent may be disregarded if the student’s family

circumstances mean that it would be unfair to the student not to do so.

(7) If paragraph 6

(meaning of relevant income of certain dependent students living with a single

parent) applies, this paragraph has effect with the modifications specified in paragraph 6(5).

4 Meaning

of relevant income of dependent student living with relevant person

(1) This paragraph applies

in the case of a dependent student who lives in their main residence in Jersey

with a parent and a relevant person, unless paragraph 3(1)(b) applies.

(2) A “relevant

person” is, for the purposes of Article 51(e)(iii) of the Law (grants

and loans), a person who –

(a) is

not a parent of the dependent student;

(b) is

married to, or is in a marriage-like relationship with that student’s

parent or has formed a civil partnership, or is in a civil partnership-like

relationship with that student’s parent; and

(c) is

living with a parent of that student.

(3) The relevant income in

respect of a dependent student for an academic year is the sum of the gross

income of the student’s parent and the gross income of the relevant

person for the calendar year preceding the calendar year in which the student’s

first module of the academic year commences.

(4) For the purposes of

determining a relevant person’s income, any amount payable by the

relevant person (whether under an order of a court or any other agreement) for

the maintenance of a person dependent on the relevant person is deducted.

(5) In sub-paragraph (4),

“a person dependent on the relevant person” does not include the

dependent student to whom this paragraph applies or the parent with whom the

relevant person is living.

(6) If a relevant person

dies during an academic year, the amount of their income that has been applied

for the purposes of calculating the dependent student’s relevant income for

the academic year is reduced by a portion equivalent to the unexpired portion

of that academic year.

(7) The income of a relevant

person is disregarded if –

(a) the relevant

person dies before the student’s first module of the academic year commences;

or

(b) the

student is the subject of any order committing the student to the care of the

Minister for Children and Families made under the Children (Jersey) Law 2002 or was the subject of an

order before attaining full age.

5 Meaning

of relevant income of independent student

(1) The relevant income in

respect of an independent student for an academic year is the sum of –

(a) the

student’s gross income for the calendar year

preceding the calendar year in which the student’s first module of the

academic year commences; and

(b) if –

(i) the student is

married, the student’s spouse’s gross income for the calendar year preceding the calendar year in which that module

starts;

(ii) the

student is in a civil partnership, the student’s civil partner’s

gross income for the calendar year preceding the calendar year in which that module

starts; or

(iii) the

student is living with a partner in a marriage-like relationship or a civil

partnership-like relationship, the student’s partner’s gross income

for the calendar year preceding the calendar year in which that module starts.

(2) But

the income of a student’s spouse, civil partner or partner is not taken

into account during any part of the calendar year that the student is not –

(a) married

or in a civil partnership; or

(b) living

in a marriage-like relationship or in a civil partnership-like relationship.

(3) If a student’s spouse,

civil partner or partner dies during an academic year, the amount of their

income that has been applied for the purposes of calculating the

student’s relevant income for the academic year is reduced by a portion

equivalent to the unexpired portion of that academic year.

(4) If,

as the result of an event beyond the control of the student or of their spouse,

civil partner or partner, their income for the calendar year in which the

student’s first module of the academic year commences is likely to be 80%

or less of their income for the preceding calendar year, the relevant income of

the student may be determined by reference to their gross income for the

calendar year in which the module commences.

(5) The whole or any part of the income of a student or of

their spouse, civil partner or partner may be disregarded if the

student’s family circumstances mean that it would be unfair to the

student not to do so.

6 Meaning

of relevant income of certain dependent students living with a single parent

(1) This paragraph applies if –

(a) a dependent

student lives with a single parent;

(b) an

application for a grant for a distance learning course is made, in respect of

the student, for an academic year beginning on or after 1 September 2025

(the “grant application year”);

(c) the

student was eligible for consideration for, and had applied for, a grant in

respect of that course (whether or not the grant was awarded) –

(i) in the 2021

academic year; and

(ii) in

each other academic year beginning on or after 1 September 2022 but preceding

the grant application year; and

(d) none

of the circumstances mentioned in Article 29(1)(a) to (c) have arisen in

relation to the student and the course.

(2) For the purposes of sub-paragraph (1)(a)

a student lives with a single parent if –

(a) the

student lives in their main residence in Jersey with 1 parent (the

“single parent”); and

(b) no

other parent or relevant person also lives in that main residence.

(3) Two different distance

learning courses in higher education that would together lead to a single qualification

are to be treated, for the purposes of sub-paragraph (1), as if they were

the same course.

(4) If this paragraph

applies, the relevant income in respect of the dependent student for the grant

application year is the single parent’s gross income for the calendar

year preceding the calendar year in which the grant application year begins.

(5) Paragraph 3 has

effect in relation to the dependent student with the following

modifications –

(a) Paragraph 3(2)

is disregarded (and sub-paragraph (4) of this paragraph applies instead);

(b) Paragraphs 3(3)

to (6) have effect as if each reference (however expressed) to a parent, or the

parents, of the dependent student were a reference to the single parent.

(6) In this Article,

“2021 academic year” means the academic year beginning on 1 September

2021.

7 Eligibility

for distance learning course grant

(1) A student is eligible

for consideration for a grant in respect of a distance learning course or

module only if –

(a) the

course or module forms part of a degree programme or enables the student to

continue to a degree programme at another institution by way of credit

accumulation and transfer;

(b) the

institution providing the qualification is regulated by the appropriate body in

the British Islands; and

(c) in

the opinion of the Minister, the educational provision is of a suitable

standard.

(2) When determining

whether a module, course or degree programme meets the eligibility criteria for

student to be considered for a grant, the Minister may do any of the following –

(a) require

a student to provide evidence that the module, course or degree programme meets

the standards of credit accumulation and transfer, in order for the student to

be considered for a grant;

(b) consider

guidance from a government-designated regulatory or standards-setting body in

the British Islands;

(c) consider

the outcome of an assessment or rating applied to the institution by the

appropriate body designated for that purpose in the British Islands.

8 Distance

learning course tuition fees grant

(1) For the 2025 academic

year, and subsequent academic years, the amount of tuition fees grant that may

be awarded to a student undertaking a full-time distance learning course is the

lower of –

(a) the

amount that may be awarded to a student in accordance with their relevant

income; and

(b) the

actual tuition fee applicable to the course for that academic year.

(2) The amount of tuition

fees grant that may be awarded to a student undertaking a full-time distance

learning course, in accordance with their relevant income, (their

“full-time tuition fees grant entitlement”) is as

follows –

|

|

|

|

Less than 115,720

|

9,535

|

|

115,720 or more but less than 126,240

|

8,583

|

|

126,240 or more but less than 136,760

|

7,629

|

|

136,760 or more but less than 147,280

|

6,676

|

|

147,280 or more but less than 157,800

|

5,722

|

|

157,800 or more but less than 168,320

|

4,768

|

|

168,320 or more but less than 178,840

|

3,815

|

|

178,840 or more but less than 189,360

|

2,861

|

|

189,360 or more but less than 199,880

|

1,907

|

|

199,880 or more but less than 210,400

|

954

|

|

210,400 or more

|

0

|

(3) For the 2025 academic

year, and subsequent academic years, the amount of tuition fees grant that may

be awarded to a student undertaking a part-time distance learning course

(“part-time tuition fees grant”) is determined according to the

intensity of the course, based on the number of credits awarded for the course

in that academic year, by calculating the following in order –

(a) the

full-time equivalent number of credits for each academic year of a course

(“credits per academic year”) is determined as follows –

|

Credits per academic year =

|

total number of credits awarded to the

full degree qualification

|

|

|

full-time duration of full degree qualification

(years)

|

(b) the intensity

of the course for the particular student (“course intensity”) is

determined as follows –

|

Course intensity =

|

credits to be earned by the student in

academic year

|

|

|

credits per academic year

|

(c) the

part-time tuition fees grant is determined as follows –

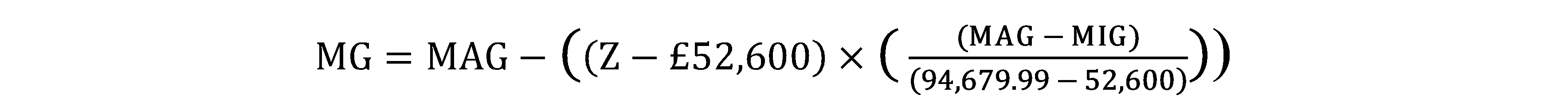

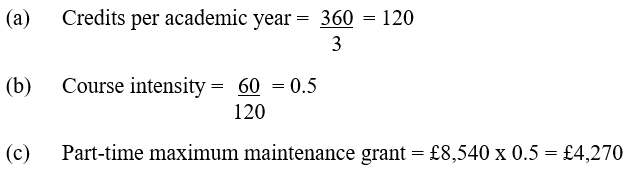

(4) For example, a student has

a relevant income of £95,000 and is undertaking a part-time distance

learning course. The full-time course has a duration of 3 years and awards a

total of 360 credits. During the academic year, the student will study 3

modules that award a total of 60 credits. Their part-time tuition fees grant

would be determined as follows –

(5) The Minister may

determine the intensity of a distance learning course by an alternative method

if a course does not attract credits.

(6) If the Minister is

unable to reasonably determine the intensity of a course, the Minister may

refuse to award a tuition fees grant in respect of that course.

9 Distance

learning course maximum maintenance grant if relevant income is less than

£52,600

(1) For the 2025 academic

year and for subsequent academic years, a student who is undertaking a

full-time distance learning course and whose relevant income is less than

£52,600 may be awarded the full-time maximum maintenance grant specified

in the following table –

(2) The amount of maximum maintenance

grant that may be awarded to a student undertaking a part-time distance

learning course (“part-time maximum maintenance grant”) is

determined according to the intensity of the course, based on the number of

credits awarded for the course in that academic year, by calculating the

following in order –

(a) the

full-time equivalent number of credits for each academic year of a course

(“credits per academic year”) is determined as follows –

|

Credits per academic year =

|

total number of credits awarded to the

full degree qualification

|

|

|

full-time duration of full degree

qualification (years)

|

(b) the intensity

of the course for the particular student (“course intensity”) is

determined as follows –

|

Course intensity =

|

credits to be earned by the student in academic

year

|

|

|

credits per academic year

|

(c) the

part-time maximum maintenance grant is determined

as follows –

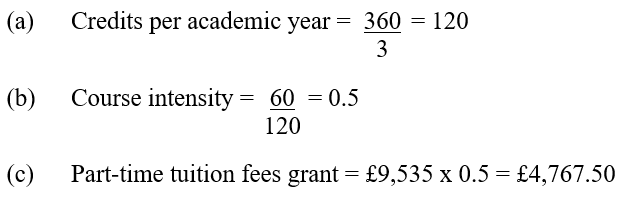

(3) For example, a dependent

student (category D) has a relevant income of £50,000 and is undertaking

a part-time distance learning course. The full-time course has a duration of

3 years and awards a total of 360 credits. During the academic year, the

student will study 3 modules that award a total of 60 credits. Their part-time

maximum maintenance grant would be determined as follows –

(4) The Minister may

determine the intensity of a distance learning course by an alternative method

if a course does not attract credits.

(5) If the Minister is

unable to reasonably determine the intensity of a course, the Minister may

refuse to award a maintenance grant in respect of that course.

10 Distance

learning course maintenance grant if relevant income is £52,600 or more,

but less than £94,680

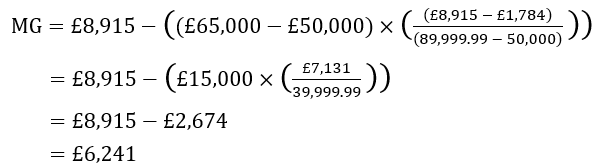

(1) For the 2025 academic

year and for subsequent academic years, a student who is undertaking a

full-time distance learning course and whose relevant income is £94,679.99

may be awarded the full-time minimum maintenance grant specified in the

following table –

(2) For the 2025 academic

year and for subsequent academic years, a student who is undertaking a

full-time distance learning course and whose relevant income is £52,600

or more, but less than £94,679.99, may be awarded a full-time maintenance

grant (“MG”) of an amount calculated using the following

formula –

(3) In the

formula –

“MAG” means the maximum full-time maintenance grant that

would be awardable if paragraph 9 applied to the student instead of sub-paragraph (2);

“MIG” means the minimum full-time maintenance grant that

would be awardable if sub-paragraph (1) applied to the student instead of sub-paragraph (2);

“Z” means the student’s relevant income.

(4) For example, the full-time

maintenance grant (“MG”) awarded to an independent student

(category E) who is undertaking a full-time distance learning course, and who

has a relevant income of £65,000, would be calculated as

follows –

(5) For the 2025 academic

year and for subsequent academic years, the amount of maintenance grant that

may be awarded to a student undertaking a part-time distance learning course

(“part-time maintenance grant”) is determined according to the

intensity of the course, based on the number of credits awarded for the course

in that academic year, by calculating the following in order –

(a) the